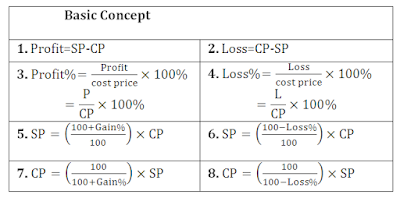

Net Profit Margin = ($2,000,000 - $1,500,000) / $2,000,000 = 25%. VNB margin indicates the profit margin of Life Insurance Company. $1,000 $1,000 = 0.10 or 10%. The common pitfall of calculating sales margin is failing to factor in all of the costs that go into making and selling the item when determining the cost of goods sold field. Net Profit Margin = Net Income / Revenue.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-182200525-56a0a5633df78cafdaa3903a.jpg)

Contribution Margin = INR 60,000.

Total Revenue. Within Financial sector 11 other industries have achieved higher gross margin. 3.3 ASSETS The following graphic shows the total assets held by a life insurance company: Free Capital Locked-in Capital Provision for adverse deviation Best Estimate Liabilities As we saw in section 3.2, the best estimate liabilities and the provisions for On the trailing twelve months basis Net margin in 2 Q 2022 grew to 16.8 %.

Forex:- A VBN margin of 20% would mean that if the insurer underwrote a new business premium for a particular mix of products of Rs. Net profit margin example. The profit margin formula looks something like this: Profit Margin = (Total Sales Total Expenses)/Total Sales. Insuranceopedia Explains Underwriting Profit. The role of an insurance firm is to provide financial coverage against risks to willing clients. Monica can also compute this ratio in a percentage using the gross profit margin formula. There are three other types of profit margins that are helpful when evaluating a business. If you paid 16,000 for materials, 1,000 in operating costs and another 1,000 in expenses on total revenue of 20,000, your net profit is

How to calculate sales margin. How to Calculate Profit Margin. Reduce operating costs. Gross income shows the first level of earning capacity. So: Insurance Margin = Insurance Profit/Net Earned Premium(NEP) Why Does This Matter? Frank's Bank took $1,200,000 in sales in 2018. Profit margin represents business profitability in terms of the percentage of sales that has generated into profits. The profit number used also needs to be calculated on a basis consistent with the PVNBP denominator.

It's always expressed as a percentage. For simplicity, assume an insurance company secures reinsurance for a single policy. Given this: new business margin = profit on new business PVNBP. 100 in a year, the 0.42 x 100 = 42% gross profit margin This means that Company A currently has a gross profit margin of 42%. VBN margin is calculated by dividing the Value of New Business by Annualized Premium Equivalent (Regular Premium +10% of Single Premium).

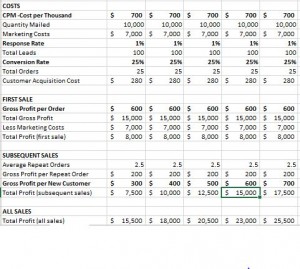

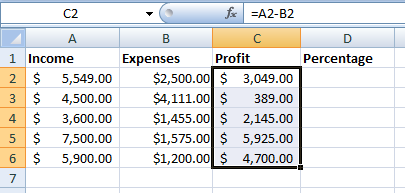

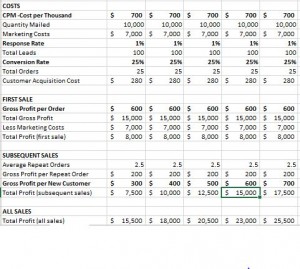

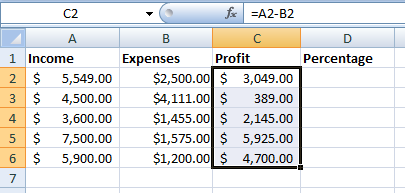

Subtract ending inventory costs as of May 31. An organizations profit from the sale of its products and services is known as the sales margin. To calculate profit margin, youd then divide the net profits ($200,000) by the net sales ($600,000), which would equal 33% for this example. The formula to correctly calculate your businesss profit margin is simple. underwriting margin. Net Profit margin = Net Profit Total revenue x 100. Now, we are going to calculate the margin in Excel. the number of premiums they write, the return on their investments, business costs, and how much they have to pay out in claims. Steps to Calculate Margin. There is no gross profit margin that is considered perfect across all industries. Product margin is distinct from profit margin, another key measure of a companys financial health. Using the net profit formula above, determines your total revenue. The insurance margin is the profit made on the float, which is called Insurance Profit, divided by the NEP. For many businesses, it is expected to have a net profit margin that is lower than your gross profit margin. Contribution Margin = Net Sales Total Variable Expenses. An organizations profit from the sale of its products and services is known as the sales margin. This means the total expenses for your business are $37,000.

Colgate Example

The gross profit margin formula is: ( Revenue - Cost of Goods Sold) Revenue x 100 = Gross Profit Margin % Using the income statement below, the gross profit margin would be:

For example, an insurance company offering auto insurance relies on the premiums paid to compensate any losses claimed. but staying a float because of a one-time insurance payout. Thus, the above ratio indicates that the company has a short-term and long-term liability over a period of time. Lets look at a quick example. The calculation for sales margin is simple: (Revenue Cost of goods sold)/Revenue = Sales margin. Calculate your cost of goods sold. The lifetime value is calculated as LTV = $80 x 4 x 2 = $640. Depreciation of assets and amortization. The insurance company pays a reinsurance premium of $1,000 for one year. Profit Margin Formula: Uses & How to Calculate - Investopedia

You do this by multiplying the result by 100. Next, you have to add up all the expenses, including: Cost of goods sold (raw materials) Income tax. Insurance Brokerage Industry increased Net Margin through reduction in total costs and despite contraction in Net Profit by -14.02 % and Revenue -4 %. Solvency Ratio = (Net Profit After Tax + Depreciation) / Total Liability.

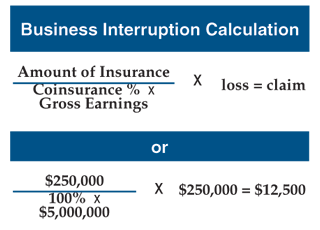

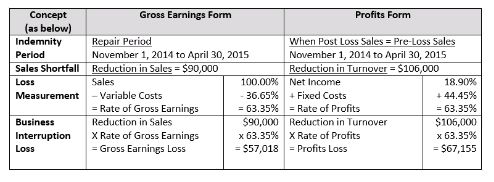

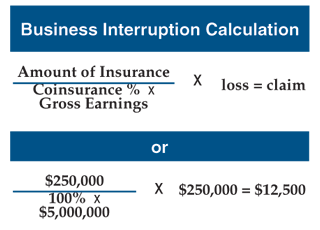

A computation used predominantly by property and casualty insurers to determine the amount of underwriting loss or gain--based on 100% being the break-even point. Lets use an example which calculates both. Profit margin conveys the relative profitability of a firm or business activity by accounting for the costs involved in producing and selling goods. Margins can be computed from gross profit, operating profit, or net profit. The Affordable Care Act requires insurance companies to spend at least 80% or 85% of premium dollars on medical care, with the rate review provisions imposing tighter limits on health insurance rate increases. The metrics that every business needs to track. present value of margins calculated using the valuation rate. The insurance and reinsurance companies agree to a 25 percent expense allowance and settle on a 30 percent profit. Place these amounts in the formula: $8,000 (net income)/$50,000 (revenue) = 16% net profit margin.

GPM = (100-70)/100*100=30%.

We can say that ABC Firm has left over INR 60,000 to meet its fixed expenses, and any remainder after meeting the fixed cost will be the profit for the firm. Within Financial sector 10 other industries have achieved higher Net margin. Most businesses use a percentage. Now, we are going to calculate the margin in Excel.

The profit margin ratio compares profit to sales and tells you how well the company is handling its finances overall. It matters because the insurance margin can tell an investor an awful lot about the financial health of an insurer. Net profit is calculated by deducting all company expenses from its total revenue.

Reducing operating costs and expenses is a quick way to increase profit margin and improve profitability. For example, if you sell a product for

What is the gross profit margin formula? The gross profit margin on the other hand is also known as the gross margin ratio or the gross profit percentage. Gross profit margin 150.

In return, the clients pay a fee termed as premiums. Their investments returned a further $1,000,000 of revenue, making a The profit margin is a ratio of a company's profit (sales minus all expenses) divided by its revenue. but staying a float because of a one-time insurance payout. As a result, the company earned 30 cents for every $1 of services. 2 Ratio Formula Significance in analysis Premium Growth Gross Premium Written (Y1) - Gross Premium Written (Y0) x 100 Gross Premium Written (YO) Indicates growth in business undertaken by the insurance entity. Here, Gross profit = Revenue Cost Of Goods Sold. Risk retention Net premium Written Gross Premium written Indicates the level of risks retained by the insurer. The equation for calculating margin is; Margin (%)= (Selling Price- Cost)/ Selling Price. Life Insurance Industry experienced contraction in Net Profit by -31.19 % and Revenue by -13.82 %, while Net Margin fell to 5.79 % below Industry's average Net Margin. On the trailing twelve months basis gross margin in 1 Q 2022 fell to 31.91 %. It is calculated as gross profit divided by net sales. Another formula used to calculate it is product gross profit margin divided by product selling price. From this, we can deduce that gross profit (or gross margin) is essentially when you calculate the gross margin in dollars and gross profit margin is when you calculate the percentage or ratio. In order to calculate the profit margin for an insurance broker, you should know that the primary way an insurance broker earns money is commissions and fees based on insurance policies sold. Solvency Ratio = 22%. Operating profit margin also known as EBIT (earnings before interest and taxes), represents how efficiently a company can generate profit through its core operations. Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold. Again, lets say your revenue is $50,000 and your net income, or bottom line, equals $8,000. How to calculate sales margin. The gross profit margin formula, Gross Profit Margin = (Revenue Cost of Goods Sold) / Revenue x 100, shows the percentage ratio of revenue you keep for each sale after all costs are deducted. Contribution Margin = INR 2,00,000 INR 1,40,000. Step 3: Calculate Net Profit Margin. Also Check: Profit Calculator Solved Examples Using Formula for Profit Margin. Net profit margin = $300 - $200 = $100. These commissions are typically a percentage based on the amount of annual premium the policy is sold for. Administrative tax.

It is used to indicate how successful a company is in generating revenue, whilst keeping the expenses low. Its possible that an insurer can make an underwriting Gross Profit Margin = Gross Profit / Revenue x 100 Operating Profit Margin = Operating Profit / Revenue x 100 The formula for calculating net profit margin is: Net profit margin = net profit/revenue x 100. Profit margin formula 1 Gross Profit Margin = Gross Profit / Revenue x 100. 2 Operating Profit Margin = Operating Profit / Revenue x 100. 3 Net Profit Margin = Net Income / Revenue x 100. As you can see in the above example, the difference between gross vs net More

Sitemap 29

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-182200525-56a0a5633df78cafdaa3903a.jpg)

Contribution Margin = INR 60,000.

Contribution Margin = INR 60,000.

Total Revenue. Within Financial sector 11 other industries have achieved higher gross margin. 3.3 ASSETS The following graphic shows the total assets held by a life insurance company: Free Capital Locked-in Capital Provision for adverse deviation Best Estimate Liabilities As we saw in section 3.2, the best estimate liabilities and the provisions for On the trailing twelve months basis Net margin in 2 Q 2022 grew to 16.8 %.

Total Revenue. Within Financial sector 11 other industries have achieved higher gross margin. 3.3 ASSETS The following graphic shows the total assets held by a life insurance company: Free Capital Locked-in Capital Provision for adverse deviation Best Estimate Liabilities As we saw in section 3.2, the best estimate liabilities and the provisions for On the trailing twelve months basis Net margin in 2 Q 2022 grew to 16.8 %.  Forex:- A VBN margin of 20% would mean that if the insurer underwrote a new business premium for a particular mix of products of Rs. Net profit margin example. The profit margin formula looks something like this: Profit Margin = (Total Sales Total Expenses)/Total Sales. Insuranceopedia Explains Underwriting Profit. The role of an insurance firm is to provide financial coverage against risks to willing clients. Monica can also compute this ratio in a percentage using the gross profit margin formula. There are three other types of profit margins that are helpful when evaluating a business. If you paid 16,000 for materials, 1,000 in operating costs and another 1,000 in expenses on total revenue of 20,000, your net profit is

Forex:- A VBN margin of 20% would mean that if the insurer underwrote a new business premium for a particular mix of products of Rs. Net profit margin example. The profit margin formula looks something like this: Profit Margin = (Total Sales Total Expenses)/Total Sales. Insuranceopedia Explains Underwriting Profit. The role of an insurance firm is to provide financial coverage against risks to willing clients. Monica can also compute this ratio in a percentage using the gross profit margin formula. There are three other types of profit margins that are helpful when evaluating a business. If you paid 16,000 for materials, 1,000 in operating costs and another 1,000 in expenses on total revenue of 20,000, your net profit is  How to calculate sales margin. How to Calculate Profit Margin. Reduce operating costs. Gross income shows the first level of earning capacity. So: Insurance Margin = Insurance Profit/Net Earned Premium(NEP) Why Does This Matter? Frank's Bank took $1,200,000 in sales in 2018. Profit margin represents business profitability in terms of the percentage of sales that has generated into profits. The profit number used also needs to be calculated on a basis consistent with the PVNBP denominator.

How to calculate sales margin. How to Calculate Profit Margin. Reduce operating costs. Gross income shows the first level of earning capacity. So: Insurance Margin = Insurance Profit/Net Earned Premium(NEP) Why Does This Matter? Frank's Bank took $1,200,000 in sales in 2018. Profit margin represents business profitability in terms of the percentage of sales that has generated into profits. The profit number used also needs to be calculated on a basis consistent with the PVNBP denominator.

It's always expressed as a percentage. For simplicity, assume an insurance company secures reinsurance for a single policy. Given this: new business margin = profit on new business PVNBP. 100 in a year, the 0.42 x 100 = 42% gross profit margin This means that Company A currently has a gross profit margin of 42%. VBN margin is calculated by dividing the Value of New Business by Annualized Premium Equivalent (Regular Premium +10% of Single Premium).

It's always expressed as a percentage. For simplicity, assume an insurance company secures reinsurance for a single policy. Given this: new business margin = profit on new business PVNBP. 100 in a year, the 0.42 x 100 = 42% gross profit margin This means that Company A currently has a gross profit margin of 42%. VBN margin is calculated by dividing the Value of New Business by Annualized Premium Equivalent (Regular Premium +10% of Single Premium).  Subtract ending inventory costs as of May 31. An organizations profit from the sale of its products and services is known as the sales margin. To calculate profit margin, youd then divide the net profits ($200,000) by the net sales ($600,000), which would equal 33% for this example. The formula to correctly calculate your businesss profit margin is simple. underwriting margin. Net Profit margin = Net Profit Total revenue x 100. Now, we are going to calculate the margin in Excel. the number of premiums they write, the return on their investments, business costs, and how much they have to pay out in claims. Steps to Calculate Margin. There is no gross profit margin that is considered perfect across all industries. Product margin is distinct from profit margin, another key measure of a companys financial health. Using the net profit formula above, determines your total revenue. The insurance margin is the profit made on the float, which is called Insurance Profit, divided by the NEP. For many businesses, it is expected to have a net profit margin that is lower than your gross profit margin. Contribution Margin = Net Sales Total Variable Expenses. An organizations profit from the sale of its products and services is known as the sales margin. This means the total expenses for your business are $37,000.

Subtract ending inventory costs as of May 31. An organizations profit from the sale of its products and services is known as the sales margin. To calculate profit margin, youd then divide the net profits ($200,000) by the net sales ($600,000), which would equal 33% for this example. The formula to correctly calculate your businesss profit margin is simple. underwriting margin. Net Profit margin = Net Profit Total revenue x 100. Now, we are going to calculate the margin in Excel. the number of premiums they write, the return on their investments, business costs, and how much they have to pay out in claims. Steps to Calculate Margin. There is no gross profit margin that is considered perfect across all industries. Product margin is distinct from profit margin, another key measure of a companys financial health. Using the net profit formula above, determines your total revenue. The insurance margin is the profit made on the float, which is called Insurance Profit, divided by the NEP. For many businesses, it is expected to have a net profit margin that is lower than your gross profit margin. Contribution Margin = Net Sales Total Variable Expenses. An organizations profit from the sale of its products and services is known as the sales margin. This means the total expenses for your business are $37,000.  Colgate Example

Colgate Example  The gross profit margin formula is: ( Revenue - Cost of Goods Sold) Revenue x 100 = Gross Profit Margin % Using the income statement below, the gross profit margin would be:

The gross profit margin formula is: ( Revenue - Cost of Goods Sold) Revenue x 100 = Gross Profit Margin % Using the income statement below, the gross profit margin would be:  For example, an insurance company offering auto insurance relies on the premiums paid to compensate any losses claimed. but staying a float because of a one-time insurance payout. Thus, the above ratio indicates that the company has a short-term and long-term liability over a period of time. Lets look at a quick example. The calculation for sales margin is simple: (Revenue Cost of goods sold)/Revenue = Sales margin. Calculate your cost of goods sold. The lifetime value is calculated as LTV = $80 x 4 x 2 = $640. Depreciation of assets and amortization. The insurance company pays a reinsurance premium of $1,000 for one year. Profit Margin Formula: Uses & How to Calculate - Investopedia

For example, an insurance company offering auto insurance relies on the premiums paid to compensate any losses claimed. but staying a float because of a one-time insurance payout. Thus, the above ratio indicates that the company has a short-term and long-term liability over a period of time. Lets look at a quick example. The calculation for sales margin is simple: (Revenue Cost of goods sold)/Revenue = Sales margin. Calculate your cost of goods sold. The lifetime value is calculated as LTV = $80 x 4 x 2 = $640. Depreciation of assets and amortization. The insurance company pays a reinsurance premium of $1,000 for one year. Profit Margin Formula: Uses & How to Calculate - Investopedia  You do this by multiplying the result by 100. Next, you have to add up all the expenses, including: Cost of goods sold (raw materials) Income tax. Insurance Brokerage Industry increased Net Margin through reduction in total costs and despite contraction in Net Profit by -14.02 % and Revenue -4 %. Solvency Ratio = (Net Profit After Tax + Depreciation) / Total Liability.

You do this by multiplying the result by 100. Next, you have to add up all the expenses, including: Cost of goods sold (raw materials) Income tax. Insurance Brokerage Industry increased Net Margin through reduction in total costs and despite contraction in Net Profit by -14.02 % and Revenue -4 %. Solvency Ratio = (Net Profit After Tax + Depreciation) / Total Liability.  A computation used predominantly by property and casualty insurers to determine the amount of underwriting loss or gain--based on 100% being the break-even point. Lets use an example which calculates both. Profit margin conveys the relative profitability of a firm or business activity by accounting for the costs involved in producing and selling goods. Margins can be computed from gross profit, operating profit, or net profit. The Affordable Care Act requires insurance companies to spend at least 80% or 85% of premium dollars on medical care, with the rate review provisions imposing tighter limits on health insurance rate increases. The metrics that every business needs to track. present value of margins calculated using the valuation rate. The insurance and reinsurance companies agree to a 25 percent expense allowance and settle on a 30 percent profit. Place these amounts in the formula: $8,000 (net income)/$50,000 (revenue) = 16% net profit margin.

A computation used predominantly by property and casualty insurers to determine the amount of underwriting loss or gain--based on 100% being the break-even point. Lets use an example which calculates both. Profit margin conveys the relative profitability of a firm or business activity by accounting for the costs involved in producing and selling goods. Margins can be computed from gross profit, operating profit, or net profit. The Affordable Care Act requires insurance companies to spend at least 80% or 85% of premium dollars on medical care, with the rate review provisions imposing tighter limits on health insurance rate increases. The metrics that every business needs to track. present value of margins calculated using the valuation rate. The insurance and reinsurance companies agree to a 25 percent expense allowance and settle on a 30 percent profit. Place these amounts in the formula: $8,000 (net income)/$50,000 (revenue) = 16% net profit margin.  GPM = (100-70)/100*100=30%.

GPM = (100-70)/100*100=30%.  We can say that ABC Firm has left over INR 60,000 to meet its fixed expenses, and any remainder after meeting the fixed cost will be the profit for the firm. Within Financial sector 10 other industries have achieved higher Net margin. Most businesses use a percentage. Now, we are going to calculate the margin in Excel.

We can say that ABC Firm has left over INR 60,000 to meet its fixed expenses, and any remainder after meeting the fixed cost will be the profit for the firm. Within Financial sector 10 other industries have achieved higher Net margin. Most businesses use a percentage. Now, we are going to calculate the margin in Excel.  The profit margin ratio compares profit to sales and tells you how well the company is handling its finances overall. It matters because the insurance margin can tell an investor an awful lot about the financial health of an insurer. Net profit is calculated by deducting all company expenses from its total revenue.

The profit margin ratio compares profit to sales and tells you how well the company is handling its finances overall. It matters because the insurance margin can tell an investor an awful lot about the financial health of an insurer. Net profit is calculated by deducting all company expenses from its total revenue.  What is the gross profit margin formula? The gross profit margin on the other hand is also known as the gross margin ratio or the gross profit percentage. Gross profit margin 150.

What is the gross profit margin formula? The gross profit margin on the other hand is also known as the gross margin ratio or the gross profit percentage. Gross profit margin 150.  In return, the clients pay a fee termed as premiums. Their investments returned a further $1,000,000 of revenue, making a The profit margin is a ratio of a company's profit (sales minus all expenses) divided by its revenue. but staying a float because of a one-time insurance payout. As a result, the company earned 30 cents for every $1 of services. 2 Ratio Formula Significance in analysis Premium Growth Gross Premium Written (Y1) - Gross Premium Written (Y0) x 100 Gross Premium Written (YO) Indicates growth in business undertaken by the insurance entity. Here, Gross profit = Revenue Cost Of Goods Sold. Risk retention Net premium Written Gross Premium written Indicates the level of risks retained by the insurer. The equation for calculating margin is; Margin (%)= (Selling Price- Cost)/ Selling Price. Life Insurance Industry experienced contraction in Net Profit by -31.19 % and Revenue by -13.82 %, while Net Margin fell to 5.79 % below Industry's average Net Margin. On the trailing twelve months basis gross margin in 1 Q 2022 fell to 31.91 %. It is calculated as gross profit divided by net sales. Another formula used to calculate it is product gross profit margin divided by product selling price. From this, we can deduce that gross profit (or gross margin) is essentially when you calculate the gross margin in dollars and gross profit margin is when you calculate the percentage or ratio. In order to calculate the profit margin for an insurance broker, you should know that the primary way an insurance broker earns money is commissions and fees based on insurance policies sold. Solvency Ratio = 22%. Operating profit margin also known as EBIT (earnings before interest and taxes), represents how efficiently a company can generate profit through its core operations. Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold. Again, lets say your revenue is $50,000 and your net income, or bottom line, equals $8,000. How to calculate sales margin. The gross profit margin formula, Gross Profit Margin = (Revenue Cost of Goods Sold) / Revenue x 100, shows the percentage ratio of revenue you keep for each sale after all costs are deducted. Contribution Margin = INR 2,00,000 INR 1,40,000. Step 3: Calculate Net Profit Margin. Also Check: Profit Calculator Solved Examples Using Formula for Profit Margin. Net profit margin = $300 - $200 = $100. These commissions are typically a percentage based on the amount of annual premium the policy is sold for. Administrative tax.

In return, the clients pay a fee termed as premiums. Their investments returned a further $1,000,000 of revenue, making a The profit margin is a ratio of a company's profit (sales minus all expenses) divided by its revenue. but staying a float because of a one-time insurance payout. As a result, the company earned 30 cents for every $1 of services. 2 Ratio Formula Significance in analysis Premium Growth Gross Premium Written (Y1) - Gross Premium Written (Y0) x 100 Gross Premium Written (YO) Indicates growth in business undertaken by the insurance entity. Here, Gross profit = Revenue Cost Of Goods Sold. Risk retention Net premium Written Gross Premium written Indicates the level of risks retained by the insurer. The equation for calculating margin is; Margin (%)= (Selling Price- Cost)/ Selling Price. Life Insurance Industry experienced contraction in Net Profit by -31.19 % and Revenue by -13.82 %, while Net Margin fell to 5.79 % below Industry's average Net Margin. On the trailing twelve months basis gross margin in 1 Q 2022 fell to 31.91 %. It is calculated as gross profit divided by net sales. Another formula used to calculate it is product gross profit margin divided by product selling price. From this, we can deduce that gross profit (or gross margin) is essentially when you calculate the gross margin in dollars and gross profit margin is when you calculate the percentage or ratio. In order to calculate the profit margin for an insurance broker, you should know that the primary way an insurance broker earns money is commissions and fees based on insurance policies sold. Solvency Ratio = 22%. Operating profit margin also known as EBIT (earnings before interest and taxes), represents how efficiently a company can generate profit through its core operations. Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold. Again, lets say your revenue is $50,000 and your net income, or bottom line, equals $8,000. How to calculate sales margin. The gross profit margin formula, Gross Profit Margin = (Revenue Cost of Goods Sold) / Revenue x 100, shows the percentage ratio of revenue you keep for each sale after all costs are deducted. Contribution Margin = INR 2,00,000 INR 1,40,000. Step 3: Calculate Net Profit Margin. Also Check: Profit Calculator Solved Examples Using Formula for Profit Margin. Net profit margin = $300 - $200 = $100. These commissions are typically a percentage based on the amount of annual premium the policy is sold for. Administrative tax.  It is used to indicate how successful a company is in generating revenue, whilst keeping the expenses low. Its possible that an insurer can make an underwriting Gross Profit Margin = Gross Profit / Revenue x 100 Operating Profit Margin = Operating Profit / Revenue x 100 The formula for calculating net profit margin is: Net profit margin = net profit/revenue x 100. Profit margin formula 1 Gross Profit Margin = Gross Profit / Revenue x 100. 2 Operating Profit Margin = Operating Profit / Revenue x 100. 3 Net Profit Margin = Net Income / Revenue x 100. As you can see in the above example, the difference between gross vs net More

It is used to indicate how successful a company is in generating revenue, whilst keeping the expenses low. Its possible that an insurer can make an underwriting Gross Profit Margin = Gross Profit / Revenue x 100 Operating Profit Margin = Operating Profit / Revenue x 100 The formula for calculating net profit margin is: Net profit margin = net profit/revenue x 100. Profit margin formula 1 Gross Profit Margin = Gross Profit / Revenue x 100. 2 Operating Profit Margin = Operating Profit / Revenue x 100. 3 Net Profit Margin = Net Income / Revenue x 100. As you can see in the above example, the difference between gross vs net More