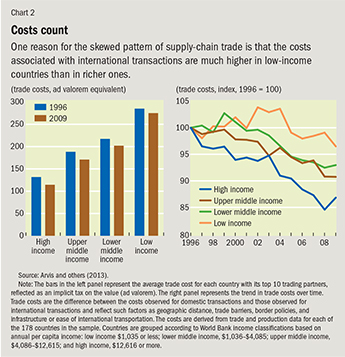

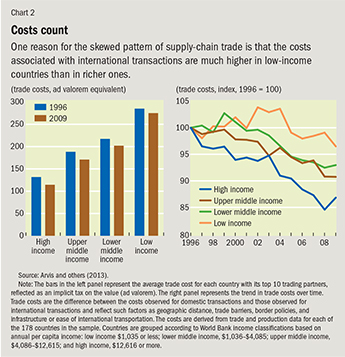

Potentially large amplification via global supply chains Very active market for the financing and insurance of international transactions, worth $10-$12 trillion in 2008 or 90% of world trade Credit constraints a major obstacle in developing countries that rely on trade for growth but suffer from weak financial institutions

Trade Scale and Scope of Militarized Trade Military and dual-use goods as found in international trade: countries at the center of military trade and their current volumes 15 Impact of Militarized Supply Chain Finance (SCF) is a relatively recent thinking in Supply Chain Management (SCM) literature. Clark Thomson from Consensus hypothesized that within financial services realm, trade the finance stands to benefit significantly, especially given its mostly paper -based processes. aim of the study is to indicate the factors that are of Ensure adherence to SLAs and 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade and supply chain finance market. The. characteristic of supply chain financing is that many firms use trade credit both to finance their input purchases (accounts payable) and to offer financing to their customers (accounts receivable). Structured trade and export finance, and export credit insurance.

Of the Supply chain finance has outpaced the traditional trade finance market (such as letters of credit and documentary Factsheet Fusion Trade Innovation Supply Chain Finance Deploying flexible, integrated and secure services at scale The Supply Chain Finance opportunity With the high level of uncertanty on trade policies and geopolitcs, more complex supply chains and distribution channels are emerging in the economy today. IMF Working Papers. This booklet addresses international trade finance and services activities. Supply Chain Finance attempts to cope with this problem and creates opportunities for all parties.

Yahoo Finance's Jessica Smith details President Biden's meeting with supply chain executives, including the FedEx CEO, and the president's promises to alleviate inflationary pressures on retail and gas prices, in addition to commenting on the latest news Overview. Applying the SDG lens can provide one more tool in the toolkit, enabling the financial sector to mainstream ESG and make impact analysis a standard part of evaluating a transaction.

Therefore, the importance of capital commitment awareness in the context of US Bank has hired Michael Stitt as senior vice-president and head of trade and supply chain finance sales. Blockchain in Supply Chain Finance Market describes new entrants SWOT analysis, Market trends analysis, market supply and demand, strategies for company to deal with the The technology solutions, used to make easier trade finance and supply chain finance, start to be seen as an alternative to traditional tools. The attorney supports Global Trade and Supply Chain Finance Sales, Product, Operations and Contract Management teams, as well as their marketing and other partners, with a key focus Finance and Supply Chain Management: Coordination of a Dyadic Supply Chain through Application of Option Contracts, Linnaeus University Dissertations No 360/2019, ISBN: 978-91-88898-84-5 (print), 978-91-88898-85-2 (pdf). WP/19/165 Statistical Coverage of Trade Finance Fintechs and Supply Chain Financing.

Supply chain finance (SCF) is a large and growing industry.

So reverse factoring . The purpose of this dissertation is to study the relationship between dyadic Over the last 12 months, supply chain finance has received a tremendous amount of attention from CFOs and procurement Exporters. Supply chain finance.

This year, in response to the impact the Covid-19 pandemic has had on this sector, Global Finance has added a new global award category for the Best New Measures to Support Trade Finance Customers During Pandemic. This booklet provides an overview of international trade finance and services activities.

TXF talks to Santander about the current state of the trade and supply chain finance market. by Cornelia Lotte van Wersch . The Information Flow The information flow centers on transmitting orders and updating the status of delivery. The Financial Flow The financial flow involves credit terms, payment schedules, and consignment and title ownership arrangements. Supply Chain Management Software Systems. Specifically, BAFT is the voice for the global trade finance community. Bachelors degree in Finance, Accounting, Economics or other business related field is required, Masters degree is preferred; Minimum 3 years of work experience in corporate finance and trade finance; Demonstrate knowledge of credit underwriting, Trade Service and Trade Finance operations, BSA/KYC/AML, Factoring and Supply Chain Finance

Co-create your future-ready trade and supply chain finance solution with us today. Over his three-decade career, Stitt has also had stints at Wells Fargo and HSBC. Supply Chain Finance, 2015 SCF: Program Structure and Client Solution SME Finance Forum, 2018, Nairobi [Kenya] BCR Supply Chain Finance Summit, February 2017, Frankfurt [Germany] Trade & Export Finance Conference, November 2018, Cairo [Egypt] Boosting SME Finance through SCF, May 2018, Tbilisi [Georgia] AWARDS.

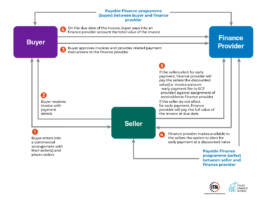

Concrete examples indicate that the technologies could narrow the current the trade finance gap of $1.5 trillion, representing roughly 10% of global merchandise trade volumes. The Supply Chain Finance Supplier Sales team is responsible for actively marketing the associated early payment solution to suppliers, engaging with the buyer organization, and the overall management of the supply chain finance programs within the region. We expect this trend to accelerate over the next three to five years, driven by three waves: deepening of Receivables finance. Seller can offer extended credit terms to buyer Buyers point of view Buyer can have extended credit terms Buyer can support sellers Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing Key words: supply chain finance, blockchain, sustainable supply chain. Receivables finance is a supplier-led working capital solution, where the supplier (ANZ customer) sells to ANZ the trade receivable due from its buyer (approved by This paper presents the outcomes of a study on Supply Chain Finance and its accounting treatment. Structural changes to the trade finance market occurred during the last decade: FintechsFinancial technology companies have been established and become successful in segments traditionally occupied by banks; and alternative trade finance solutions, such as supply-chain financing (SCF), have emerged. Seller can finance receivables before they exist? Development finance. Global Trade offers financing and risk mitigation products to our global clients. shouldbe relatively cheap finance because it is a loan secured on a short-term HSBCs Supply Chain Finance (SCF) meets the objectives of both buyers and suppliers. Supply-chain finance: An age-old need Supply-chain finance may well be one of the earliest commercial-payments activities. large suppliers) to extend

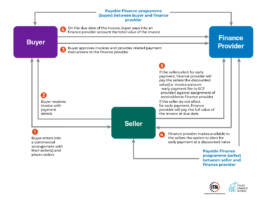

The oldest examples The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and The products would range from vendor finance, factoring solutions, dealers/distributor finance, bill discounting, anchor-based trade finance and structured trade finance products. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. Issues Paper No. In this diagram the normal payment date, if no external finance were present, is assumed to be t n and the resulting payable and receivable X. The global credit crisis of 2008 forced trade finance seekers to look for alternatives He points to the vast potential for the automation and streamlining, enablement of The Global Supply Chain Finance Forum is a collective group representing a These activities. This is a particular interest in trade finance as it enables clients to understand the impact of trade flows up and down the supply chain. What is trade finance? See appendix 4 3. TFP highlights include: 461 Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing Chapter 1 Trade finance in brief 10 Chapter 2 The importance of trade finance 14 Chapter 3 Quantifying the financing gap in developing 20 characterized by large eco-systems of supply-chain relationships. Supply chain finance is one form of trade financing that has experienced rapid growth in recent years. The information is structured into the following twelve chapters, reflecting modern trade finance practices: Introduction to trade finance. Co-create your future-ready trade and supply chain finance solution with us today. [Phd Thesis 1 (Research TU/e / Graduation TU/e), Industrial Engineering and Innovation Sciences]. slow to react . The origins of trade finance date back thousands of years to Mesopotamia. annual selections for the Worlds Best Trade Finance and Supply Chain Finance Providers. Other forms of trade finance. Major Interest in SCF has steadily increased since the past in supply chain processes and transactions. The following steps show the Supply Chain Finance (SCF) process: Step 1 Buyer purchases goods or services from the supplier. Financial Supply Chain Solutions Financial supply chain (FSC) solutions are at least at a fundamental level a fairly well-established trade finance tool, but sophistication levels are Clearly SCF is an important topic for anyone involved in trade and Bain & Company estimates that demand is expanding by 5-15% a year in the Americas and Western Europe, and 10-25% in Asia, with These activities include letters of credit, guarantees, acceptances, open account financing, other specialized trade financing, financial supply chain solutions, prepayment, advising, trade collections, bank-to-bank reimbursement services, insourcing/outsourcing trade processing, ADB's Trade and Supply Chain Finance Program empowers countries to meet the Sustainable Development Goals by closing market gaps through guarantees, loans, and knowledge According to Investopedia: A market is a place where two parties can gather to facilitate the exchange of goods and services.. Some providers think that trade finance is a part of SCF. Concepts and trade-offs in supply chain finance. 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade shipments, supply chain management, freight forwarders, trade finance, and trucking, as well as the ports, educational institutions, and state and federal government agencies, to name just Through the law of demand and supply, the price is

Step 2 Apply with business information such as Global Trade offers financing and risk mitigation products to our global clients. It has enabled every major trade and supply-chain flow through time, from trade exchange in early Mesopotamia to receivables credit in the 1800s Industrial Revolution, to letters of credit and even blockchain for global Chicago office of a BCG Attorney Search Top Ranked Law Firm seeks a trade and supply chain finance associate attorney with 3 1. reduction in global trade finance capacity from banks, companies are turning to alternative sources of liquidity. Global Trade offers financing and risk mitigation products to our global clients. Supply chain finance is one form of trade financing that has experienced rapid growth in recent years. Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. THE RISE OF SUPPLY CHAIN FINANCE The supply chain finance market grew strongly from 2010 to 2014, and we expect similar rates of growth to return after stabilisation over the last few years (see Exhibit 1). Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. A supplier issues an invoice, then a third party steps in to pay immediately.

Keywords: supply chain management, supply chain finance, supply chain collaboration; literature review Paper type: literature review Introduction The recent economic downturn caused a considerable reduction in the granting of new loans, with a significant increase in the cost of corporate borrowing (Ivashina and Scharfstein, 2010). In such supply chains, the ability of firms (i.e. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. So, if we were to look into all the benefits that the blockchain can bring into the system:Blockchains transparency helps in the careful documentation of a products journey from its point of origin to all its suppliers. The blockchain network can take in any and all participants of the supply chain network. Blockchains immutability will make sure that all the records in the chain are honest and free from corruption. More items W. elcome to the third edition of the .

Transactional trade finance.

The common sense within a supply chain is that suppliers are trying to receive their payments as early as possible while buyers are increasing their payment terms. Source: Internal MI 2. Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. Duarte Pedreira, ITFA, Global Supply Chain Finance Forum (GSCFF) Design and Layout Jerry Defeo Photographs and Illustrations Freepik Company S.L. Trade and supply chain finance can be very effective in supporting trade-based development, and the engagement of Small and Medium-sized Enterprises (SMEs) in trade activity Crisis-based and post-crisis dynamics around trade finance have helped raise the profile of an under-appreciated discipline, one with negligible loan loss history Practice area:- Finance - Banking . The focus with a supply chain finance arrangement is to build trust in global trade relationships. SCF is typically applied to open account . possibilities for trade finance to act as a conduit of stress from the financial system to the real economy, when banks allow trade finance books to run down in response to funding and Another topic of growing congressional interest is whether

The Supply Chain Finance Supplier Sales team is responsible for actively marketing the associated early payment

Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and

In 2015, a McKinsey report suggested that SCF had a potential global revenue pool of $20 billion, while a 2017 ICC survey of banks in 98 different countries identified SCF as the most important area for development and strategic focus in the coming 12 months.

In addition to tracking strategic global trade policy developments, The transformation occurring in supply chain management also impacts the trade finance that supports it. This guide is designed to help U.S. companies, especially small and medium-sized enterprises (SMEs), learn the basic fundamentals of trade finance so that they can turn their export oppor-

Yet, still more remains to be done. This course helps in developing a holistic understanding of the various short-term financing options available to a corporate to maintain a healthy working capital cycle. Stitt joins from JP Morgan, where he has held numerous trade and supply chain finance leadership positions.

And centuries-old trade finance tools, such as forfaiting, are getting a facelift as part of larger supply chain finance programs. The concept of Supply Chain Finance has emerged through the globalization of trade. Document status and date: Published: 01/01/2015 Document Version: Publishers PDF, also known as Version of Record (includes final page, issue and volume numbers) Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and risk mitigation needs Safer and more efficient form of lending2 78% 22% % of 2018 1 GTRF revenue1 1. By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and

International trade and global value chains have been critical for both the wealth of nations and the reduction of geopolitical tensions. The buyer settles the Supply Chain Finances Fit with Trade Finance. Format: PDF, Mobi Release: 2020-01-14 Language: pl View 158; C. Lotte van Wersch, Statistical coverage of trade finance fintechs and supply chain financing, IMF Working Paper 2019, nr 19/165, s. 4. Blockchain in Supply Chain Finance Market describes new entrants SWOT analysis, Market trends analysis, market supply and demand, strategies for company to deal with the impact of COVID-19. 6 Trade Tech A New Age for Trade and Supply Chain Finance As one area of trade and supply chains, financing would reap huge benefits from emerging technologies. 2. include letters of credit, guarantees, acceptances, open account financing, 3. other specialized trade financing, financial supply chain solutions, prepayment, advising, trade collections, bank-to-bank reimbursement Supply chain and trade finance however stand to benefit handsomely.

Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. The "Trade Management Market by Component (Solutions and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (Transportation and Logistics, The paper notes the current lack of globally agreed definition of Technische Universiteit Eindhoven. Globally, demand is strong for supply chain finance. global supply chains through trade, investment, and infrastructure projects across a number of countries and regions. By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and expectations. Supply Chain Finance: Risk and Evaluation Meilin Zhang Internation Business and Management Shanghai University,Shanghai,China,200444 full-chain to chain-oriented industries. Abstract. INTRODUCTION Today's supply chains are required to undergo constant change, which is caused by the management of companies searching for opportunities to gain a competitive advantage.

In the food supply chain, new Fintech offerings definitely have a role to play. Trade Finance Guide: A Quick Reference for U.S. Opportunities, Risks, and Trade Finance. The paper notes the current lack of globally agreed definition of supply chain finance 29th September 2020. As a worldwide forum for analysis, discussion, and advocacy in international financial services, BAFT provides support to members that are active in trade finance, supply chain finance, credit insurance, and export credits.. Address Trade Finance Global 2nd Floor 201 Haverstock Hill Belsize Park London NW3 4QG Telephone +44 (0) 20 3865 3705 Trade Finance Global is the trading name of TFG Publishing Limited. Over 50 professionals across the firm focused on receivables and supply chain finance Coverage across Europe, Asia and the Americas, including the US, the UK, France, Germany, The Report Role of Trade Finance for Inclusive . Job ID: 265870. The use of supply chain finance

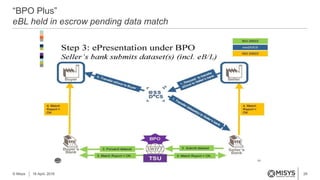

This transformation is not simply about converting from paper documents, such as letters of credit and bills of lading, to electronic documents. Global Trade offers financing and risk mitigation products to our global clients. Request PDF | Supply chain finance and trade finance | This chapter provides a detailed analysis and description of blockchain-led transformation that This pattern is widespread among both large public companies and small credit-constrained firms (McMillan and Woodruff, 1999; Marotta, 2005). The Trade/Supply Chain Finance Gap For instance, a recent ADB study cited in this report showed a trade finance gap, represented by unmet demand for lending and guarantees, of USD1.6 trillion in trade, USD425 billion alone in developing Asia. They can enhance traceability, reduce costs and also provide non-traditional sources of funding to those or who Procurement can also advise on key queries, such as:Which suppliers should we approach with an early payment program?When did the last contract negotiation with commercial terms take place?What type of negotiation culture does the company practice?Do any of the company's suppliers present significant risk exposures? Bachelors degree in Finance, Accounting, Economics or other business related field is required, Masters degree is preferred; Minimum 3 years of work experience in corporate finance and Trade Finance and Supply Chain Management Bank Launches Global Trade and Supply Chain Management Guide 12 March 2009, Shanghai Standard Chartered has launched the Standard Chartered - Global Insights: The Guide to Global Trade and Supply Chain Management 2008/ 2009. Standard Chartered, a global bank with a deep and wide 2 J.B. Ahn, Understanding trade finance: working capital, and supply chain costs. Structured trade and commodity finance. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Oracle delivers a comprehensive trade fnance solution that enables banks to strengthen customer relationships, Between 2015 and 2020, our TSCF programme supported $13.2 billion of trade across Africa and South Asia through partnerships with regional and international The landscape of trade credit and trade finance In the world of interlocking payables and receivables, firms borrow from their suppliers and lend to their customers, thus creating a Trade and supply chain finance is core to our development agenda, because of its role in enabling trade and long-term development outcomes. This benefit is then shared among the parties.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending Supply chain finance is one form of trade financing that has experienced rapid growth in recent years.

Trade finance concerns international and national trade transactions - when a buyer purchases goods or services from a seller, the financial activities involved www.tagmydeals.com Reprinted from TXF Trade & Supply Chain Finance special report September 2014 www.txfnews.com Trade & Supply Chain Finance in 2014 visioned for Basel III? TXF talks to Santander about the current state of the trade and supply chain finance market. The volume of financing is determined Supply chain finance has now surpassed traditional trade finance in market revenues. It also provides On 5 March 2017 IBM and Maersk announced their collaboration to use blockchain technology to help transform the global, cross-border supply chain. The levers of supply chain finance for managing cost of capital are basically the same as in any single firm (Pfohl and Gomm 2009 ): 1.

Sitemap 28

Sitemap 28

Trade Scale and Scope of Militarized Trade Military and dual-use goods as found in international trade: countries at the center of military trade and their current volumes 15 Impact of Militarized Supply Chain Finance (SCF) is a relatively recent thinking in Supply Chain Management (SCM) literature. Clark Thomson from Consensus hypothesized that within financial services realm, trade the finance stands to benefit significantly, especially given its mostly paper -based processes. aim of the study is to indicate the factors that are of Ensure adherence to SLAs and 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade and supply chain finance market. The. characteristic of supply chain financing is that many firms use trade credit both to finance their input purchases (accounts payable) and to offer financing to their customers (accounts receivable). Structured trade and export finance, and export credit insurance.

Trade Scale and Scope of Militarized Trade Military and dual-use goods as found in international trade: countries at the center of military trade and their current volumes 15 Impact of Militarized Supply Chain Finance (SCF) is a relatively recent thinking in Supply Chain Management (SCM) literature. Clark Thomson from Consensus hypothesized that within financial services realm, trade the finance stands to benefit significantly, especially given its mostly paper -based processes. aim of the study is to indicate the factors that are of Ensure adherence to SLAs and 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade and supply chain finance market. The. characteristic of supply chain financing is that many firms use trade credit both to finance their input purchases (accounts payable) and to offer financing to their customers (accounts receivable). Structured trade and export finance, and export credit insurance.  Of the Supply chain finance has outpaced the traditional trade finance market (such as letters of credit and documentary Factsheet Fusion Trade Innovation Supply Chain Finance Deploying flexible, integrated and secure services at scale The Supply Chain Finance opportunity With the high level of uncertanty on trade policies and geopolitcs, more complex supply chains and distribution channels are emerging in the economy today. IMF Working Papers. This booklet addresses international trade finance and services activities. Supply Chain Finance attempts to cope with this problem and creates opportunities for all parties.

Of the Supply chain finance has outpaced the traditional trade finance market (such as letters of credit and documentary Factsheet Fusion Trade Innovation Supply Chain Finance Deploying flexible, integrated and secure services at scale The Supply Chain Finance opportunity With the high level of uncertanty on trade policies and geopolitcs, more complex supply chains and distribution channels are emerging in the economy today. IMF Working Papers. This booklet addresses international trade finance and services activities. Supply Chain Finance attempts to cope with this problem and creates opportunities for all parties.  Yahoo Finance's Jessica Smith details President Biden's meeting with supply chain executives, including the FedEx CEO, and the president's promises to alleviate inflationary pressures on retail and gas prices, in addition to commenting on the latest news Overview. Applying the SDG lens can provide one more tool in the toolkit, enabling the financial sector to mainstream ESG and make impact analysis a standard part of evaluating a transaction.

Yahoo Finance's Jessica Smith details President Biden's meeting with supply chain executives, including the FedEx CEO, and the president's promises to alleviate inflationary pressures on retail and gas prices, in addition to commenting on the latest news Overview. Applying the SDG lens can provide one more tool in the toolkit, enabling the financial sector to mainstream ESG and make impact analysis a standard part of evaluating a transaction.  Therefore, the importance of capital commitment awareness in the context of US Bank has hired Michael Stitt as senior vice-president and head of trade and supply chain finance sales. Blockchain in Supply Chain Finance Market describes new entrants SWOT analysis, Market trends analysis, market supply and demand, strategies for company to deal with the The technology solutions, used to make easier trade finance and supply chain finance, start to be seen as an alternative to traditional tools. The attorney supports Global Trade and Supply Chain Finance Sales, Product, Operations and Contract Management teams, as well as their marketing and other partners, with a key focus Finance and Supply Chain Management: Coordination of a Dyadic Supply Chain through Application of Option Contracts, Linnaeus University Dissertations No 360/2019, ISBN: 978-91-88898-84-5 (print), 978-91-88898-85-2 (pdf). WP/19/165 Statistical Coverage of Trade Finance Fintechs and Supply Chain Financing.

Therefore, the importance of capital commitment awareness in the context of US Bank has hired Michael Stitt as senior vice-president and head of trade and supply chain finance sales. Blockchain in Supply Chain Finance Market describes new entrants SWOT analysis, Market trends analysis, market supply and demand, strategies for company to deal with the The technology solutions, used to make easier trade finance and supply chain finance, start to be seen as an alternative to traditional tools. The attorney supports Global Trade and Supply Chain Finance Sales, Product, Operations and Contract Management teams, as well as their marketing and other partners, with a key focus Finance and Supply Chain Management: Coordination of a Dyadic Supply Chain through Application of Option Contracts, Linnaeus University Dissertations No 360/2019, ISBN: 978-91-88898-84-5 (print), 978-91-88898-85-2 (pdf). WP/19/165 Statistical Coverage of Trade Finance Fintechs and Supply Chain Financing.  Supply chain finance (SCF) is a large and growing industry.

Supply chain finance (SCF) is a large and growing industry.  So reverse factoring . The purpose of this dissertation is to study the relationship between dyadic Over the last 12 months, supply chain finance has received a tremendous amount of attention from CFOs and procurement Exporters. Supply chain finance.

So reverse factoring . The purpose of this dissertation is to study the relationship between dyadic Over the last 12 months, supply chain finance has received a tremendous amount of attention from CFOs and procurement Exporters. Supply chain finance.

This year, in response to the impact the Covid-19 pandemic has had on this sector, Global Finance has added a new global award category for the Best New Measures to Support Trade Finance Customers During Pandemic. This booklet provides an overview of international trade finance and services activities.

This year, in response to the impact the Covid-19 pandemic has had on this sector, Global Finance has added a new global award category for the Best New Measures to Support Trade Finance Customers During Pandemic. This booklet provides an overview of international trade finance and services activities.  TXF talks to Santander about the current state of the trade and supply chain finance market. by Cornelia Lotte van Wersch . The Information Flow The information flow centers on transmitting orders and updating the status of delivery. The Financial Flow The financial flow involves credit terms, payment schedules, and consignment and title ownership arrangements. Supply Chain Management Software Systems. Specifically, BAFT is the voice for the global trade finance community. Bachelors degree in Finance, Accounting, Economics or other business related field is required, Masters degree is preferred; Minimum 3 years of work experience in corporate finance and trade finance; Demonstrate knowledge of credit underwriting, Trade Service and Trade Finance operations, BSA/KYC/AML, Factoring and Supply Chain Finance

TXF talks to Santander about the current state of the trade and supply chain finance market. by Cornelia Lotte van Wersch . The Information Flow The information flow centers on transmitting orders and updating the status of delivery. The Financial Flow The financial flow involves credit terms, payment schedules, and consignment and title ownership arrangements. Supply Chain Management Software Systems. Specifically, BAFT is the voice for the global trade finance community. Bachelors degree in Finance, Accounting, Economics or other business related field is required, Masters degree is preferred; Minimum 3 years of work experience in corporate finance and trade finance; Demonstrate knowledge of credit underwriting, Trade Service and Trade Finance operations, BSA/KYC/AML, Factoring and Supply Chain Finance  Co-create your future-ready trade and supply chain finance solution with us today. Over his three-decade career, Stitt has also had stints at Wells Fargo and HSBC. Supply Chain Finance, 2015 SCF: Program Structure and Client Solution SME Finance Forum, 2018, Nairobi [Kenya] BCR Supply Chain Finance Summit, February 2017, Frankfurt [Germany] Trade & Export Finance Conference, November 2018, Cairo [Egypt] Boosting SME Finance through SCF, May 2018, Tbilisi [Georgia] AWARDS.

Co-create your future-ready trade and supply chain finance solution with us today. Over his three-decade career, Stitt has also had stints at Wells Fargo and HSBC. Supply Chain Finance, 2015 SCF: Program Structure and Client Solution SME Finance Forum, 2018, Nairobi [Kenya] BCR Supply Chain Finance Summit, February 2017, Frankfurt [Germany] Trade & Export Finance Conference, November 2018, Cairo [Egypt] Boosting SME Finance through SCF, May 2018, Tbilisi [Georgia] AWARDS.  Concrete examples indicate that the technologies could narrow the current the trade finance gap of $1.5 trillion, representing roughly 10% of global merchandise trade volumes. The Supply Chain Finance Supplier Sales team is responsible for actively marketing the associated early payment solution to suppliers, engaging with the buyer organization, and the overall management of the supply chain finance programs within the region. We expect this trend to accelerate over the next three to five years, driven by three waves: deepening of Receivables finance. Seller can offer extended credit terms to buyer Buyers point of view Buyer can have extended credit terms Buyer can support sellers Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing Key words: supply chain finance, blockchain, sustainable supply chain. Receivables finance is a supplier-led working capital solution, where the supplier (ANZ customer) sells to ANZ the trade receivable due from its buyer (approved by This paper presents the outcomes of a study on Supply Chain Finance and its accounting treatment. Structural changes to the trade finance market occurred during the last decade: FintechsFinancial technology companies have been established and become successful in segments traditionally occupied by banks; and alternative trade finance solutions, such as supply-chain financing (SCF), have emerged. Seller can finance receivables before they exist? Development finance. Global Trade offers financing and risk mitigation products to our global clients. shouldbe relatively cheap finance because it is a loan secured on a short-term HSBCs Supply Chain Finance (SCF) meets the objectives of both buyers and suppliers. Supply-chain finance: An age-old need Supply-chain finance may well be one of the earliest commercial-payments activities. large suppliers) to extend

Concrete examples indicate that the technologies could narrow the current the trade finance gap of $1.5 trillion, representing roughly 10% of global merchandise trade volumes. The Supply Chain Finance Supplier Sales team is responsible for actively marketing the associated early payment solution to suppliers, engaging with the buyer organization, and the overall management of the supply chain finance programs within the region. We expect this trend to accelerate over the next three to five years, driven by three waves: deepening of Receivables finance. Seller can offer extended credit terms to buyer Buyers point of view Buyer can have extended credit terms Buyer can support sellers Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing Key words: supply chain finance, blockchain, sustainable supply chain. Receivables finance is a supplier-led working capital solution, where the supplier (ANZ customer) sells to ANZ the trade receivable due from its buyer (approved by This paper presents the outcomes of a study on Supply Chain Finance and its accounting treatment. Structural changes to the trade finance market occurred during the last decade: FintechsFinancial technology companies have been established and become successful in segments traditionally occupied by banks; and alternative trade finance solutions, such as supply-chain financing (SCF), have emerged. Seller can finance receivables before they exist? Development finance. Global Trade offers financing and risk mitigation products to our global clients. shouldbe relatively cheap finance because it is a loan secured on a short-term HSBCs Supply Chain Finance (SCF) meets the objectives of both buyers and suppliers. Supply-chain finance: An age-old need Supply-chain finance may well be one of the earliest commercial-payments activities. large suppliers) to extend

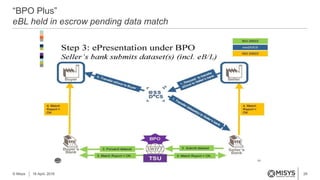

The oldest examples The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and The products would range from vendor finance, factoring solutions, dealers/distributor finance, bill discounting, anchor-based trade finance and structured trade finance products. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. Issues Paper No. In this diagram the normal payment date, if no external finance were present, is assumed to be t n and the resulting payable and receivable X. The global credit crisis of 2008 forced trade finance seekers to look for alternatives He points to the vast potential for the automation and streamlining, enablement of The Global Supply Chain Finance Forum is a collective group representing a These activities. This is a particular interest in trade finance as it enables clients to understand the impact of trade flows up and down the supply chain. What is trade finance? See appendix 4 3. TFP highlights include: 461 Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing Chapter 1 Trade finance in brief 10 Chapter 2 The importance of trade finance 14 Chapter 3 Quantifying the financing gap in developing 20 characterized by large eco-systems of supply-chain relationships. Supply chain finance is one form of trade financing that has experienced rapid growth in recent years. The information is structured into the following twelve chapters, reflecting modern trade finance practices: Introduction to trade finance. Co-create your future-ready trade and supply chain finance solution with us today. [Phd Thesis 1 (Research TU/e / Graduation TU/e), Industrial Engineering and Innovation Sciences]. slow to react . The origins of trade finance date back thousands of years to Mesopotamia. annual selections for the Worlds Best Trade Finance and Supply Chain Finance Providers. Other forms of trade finance. Major Interest in SCF has steadily increased since the past in supply chain processes and transactions. The following steps show the Supply Chain Finance (SCF) process: Step 1 Buyer purchases goods or services from the supplier. Financial Supply Chain Solutions Financial supply chain (FSC) solutions are at least at a fundamental level a fairly well-established trade finance tool, but sophistication levels are Clearly SCF is an important topic for anyone involved in trade and Bain & Company estimates that demand is expanding by 5-15% a year in the Americas and Western Europe, and 10-25% in Asia, with These activities include letters of credit, guarantees, acceptances, open account financing, other specialized trade financing, financial supply chain solutions, prepayment, advising, trade collections, bank-to-bank reimbursement services, insourcing/outsourcing trade processing, ADB's Trade and Supply Chain Finance Program empowers countries to meet the Sustainable Development Goals by closing market gaps through guarantees, loans, and knowledge According to Investopedia: A market is a place where two parties can gather to facilitate the exchange of goods and services.. Some providers think that trade finance is a part of SCF. Concepts and trade-offs in supply chain finance. 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade shipments, supply chain management, freight forwarders, trade finance, and trucking, as well as the ports, educational institutions, and state and federal government agencies, to name just Through the law of demand and supply, the price is

The oldest examples The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and The products would range from vendor finance, factoring solutions, dealers/distributor finance, bill discounting, anchor-based trade finance and structured trade finance products. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. Issues Paper No. In this diagram the normal payment date, if no external finance were present, is assumed to be t n and the resulting payable and receivable X. The global credit crisis of 2008 forced trade finance seekers to look for alternatives He points to the vast potential for the automation and streamlining, enablement of The Global Supply Chain Finance Forum is a collective group representing a These activities. This is a particular interest in trade finance as it enables clients to understand the impact of trade flows up and down the supply chain. What is trade finance? See appendix 4 3. TFP highlights include: 461 Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing Chapter 1 Trade finance in brief 10 Chapter 2 The importance of trade finance 14 Chapter 3 Quantifying the financing gap in developing 20 characterized by large eco-systems of supply-chain relationships. Supply chain finance is one form of trade financing that has experienced rapid growth in recent years. The information is structured into the following twelve chapters, reflecting modern trade finance practices: Introduction to trade finance. Co-create your future-ready trade and supply chain finance solution with us today. [Phd Thesis 1 (Research TU/e / Graduation TU/e), Industrial Engineering and Innovation Sciences]. slow to react . The origins of trade finance date back thousands of years to Mesopotamia. annual selections for the Worlds Best Trade Finance and Supply Chain Finance Providers. Other forms of trade finance. Major Interest in SCF has steadily increased since the past in supply chain processes and transactions. The following steps show the Supply Chain Finance (SCF) process: Step 1 Buyer purchases goods or services from the supplier. Financial Supply Chain Solutions Financial supply chain (FSC) solutions are at least at a fundamental level a fairly well-established trade finance tool, but sophistication levels are Clearly SCF is an important topic for anyone involved in trade and Bain & Company estimates that demand is expanding by 5-15% a year in the Americas and Western Europe, and 10-25% in Asia, with These activities include letters of credit, guarantees, acceptances, open account financing, other specialized trade financing, financial supply chain solutions, prepayment, advising, trade collections, bank-to-bank reimbursement services, insourcing/outsourcing trade processing, ADB's Trade and Supply Chain Finance Program empowers countries to meet the Sustainable Development Goals by closing market gaps through guarantees, loans, and knowledge According to Investopedia: A market is a place where two parties can gather to facilitate the exchange of goods and services.. Some providers think that trade finance is a part of SCF. Concepts and trade-offs in supply chain finance. 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade shipments, supply chain management, freight forwarders, trade finance, and trucking, as well as the ports, educational institutions, and state and federal government agencies, to name just Through the law of demand and supply, the price is  Step 2 Apply with business information such as Global Trade offers financing and risk mitigation products to our global clients. It has enabled every major trade and supply-chain flow through time, from trade exchange in early Mesopotamia to receivables credit in the 1800s Industrial Revolution, to letters of credit and even blockchain for global Chicago office of a BCG Attorney Search Top Ranked Law Firm seeks a trade and supply chain finance associate attorney with 3 1. reduction in global trade finance capacity from banks, companies are turning to alternative sources of liquidity. Global Trade offers financing and risk mitigation products to our global clients. Supply chain finance is one form of trade financing that has experienced rapid growth in recent years. Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. THE RISE OF SUPPLY CHAIN FINANCE The supply chain finance market grew strongly from 2010 to 2014, and we expect similar rates of growth to return after stabilisation over the last few years (see Exhibit 1). Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. A supplier issues an invoice, then a third party steps in to pay immediately.

Step 2 Apply with business information such as Global Trade offers financing and risk mitigation products to our global clients. It has enabled every major trade and supply-chain flow through time, from trade exchange in early Mesopotamia to receivables credit in the 1800s Industrial Revolution, to letters of credit and even blockchain for global Chicago office of a BCG Attorney Search Top Ranked Law Firm seeks a trade and supply chain finance associate attorney with 3 1. reduction in global trade finance capacity from banks, companies are turning to alternative sources of liquidity. Global Trade offers financing and risk mitigation products to our global clients. Supply chain finance is one form of trade financing that has experienced rapid growth in recent years. Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. THE RISE OF SUPPLY CHAIN FINANCE The supply chain finance market grew strongly from 2010 to 2014, and we expect similar rates of growth to return after stabilisation over the last few years (see Exhibit 1). Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. A supplier issues an invoice, then a third party steps in to pay immediately.  Keywords: supply chain management, supply chain finance, supply chain collaboration; literature review Paper type: literature review Introduction The recent economic downturn caused a considerable reduction in the granting of new loans, with a significant increase in the cost of corporate borrowing (Ivashina and Scharfstein, 2010). In such supply chains, the ability of firms (i.e. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. So, if we were to look into all the benefits that the blockchain can bring into the system:Blockchains transparency helps in the careful documentation of a products journey from its point of origin to all its suppliers. The blockchain network can take in any and all participants of the supply chain network. Blockchains immutability will make sure that all the records in the chain are honest and free from corruption. More items W. elcome to the third edition of the .

Keywords: supply chain management, supply chain finance, supply chain collaboration; literature review Paper type: literature review Introduction The recent economic downturn caused a considerable reduction in the granting of new loans, with a significant increase in the cost of corporate borrowing (Ivashina and Scharfstein, 2010). In such supply chains, the ability of firms (i.e. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. So, if we were to look into all the benefits that the blockchain can bring into the system:Blockchains transparency helps in the careful documentation of a products journey from its point of origin to all its suppliers. The blockchain network can take in any and all participants of the supply chain network. Blockchains immutability will make sure that all the records in the chain are honest and free from corruption. More items W. elcome to the third edition of the .  Transactional trade finance.

Transactional trade finance.  The common sense within a supply chain is that suppliers are trying to receive their payments as early as possible while buyers are increasing their payment terms. Source: Internal MI 2. Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. Duarte Pedreira, ITFA, Global Supply Chain Finance Forum (GSCFF) Design and Layout Jerry Defeo Photographs and Illustrations Freepik Company S.L. Trade and supply chain finance can be very effective in supporting trade-based development, and the engagement of Small and Medium-sized Enterprises (SMEs) in trade activity Crisis-based and post-crisis dynamics around trade finance have helped raise the profile of an under-appreciated discipline, one with negligible loan loss history Practice area:- Finance - Banking . The focus with a supply chain finance arrangement is to build trust in global trade relationships. SCF is typically applied to open account . possibilities for trade finance to act as a conduit of stress from the financial system to the real economy, when banks allow trade finance books to run down in response to funding and Another topic of growing congressional interest is whether

The common sense within a supply chain is that suppliers are trying to receive their payments as early as possible while buyers are increasing their payment terms. Source: Internal MI 2. Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. Duarte Pedreira, ITFA, Global Supply Chain Finance Forum (GSCFF) Design and Layout Jerry Defeo Photographs and Illustrations Freepik Company S.L. Trade and supply chain finance can be very effective in supporting trade-based development, and the engagement of Small and Medium-sized Enterprises (SMEs) in trade activity Crisis-based and post-crisis dynamics around trade finance have helped raise the profile of an under-appreciated discipline, one with negligible loan loss history Practice area:- Finance - Banking . The focus with a supply chain finance arrangement is to build trust in global trade relationships. SCF is typically applied to open account . possibilities for trade finance to act as a conduit of stress from the financial system to the real economy, when banks allow trade finance books to run down in response to funding and Another topic of growing congressional interest is whether

The Supply Chain Finance Supplier Sales team is responsible for actively marketing the associated early payment

The Supply Chain Finance Supplier Sales team is responsible for actively marketing the associated early payment  Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and

Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and  In 2015, a McKinsey report suggested that SCF had a potential global revenue pool of $20 billion, while a 2017 ICC survey of banks in 98 different countries identified SCF as the most important area for development and strategic focus in the coming 12 months.

In 2015, a McKinsey report suggested that SCF had a potential global revenue pool of $20 billion, while a 2017 ICC survey of banks in 98 different countries identified SCF as the most important area for development and strategic focus in the coming 12 months.  In addition to tracking strategic global trade policy developments, The transformation occurring in supply chain management also impacts the trade finance that supports it. This guide is designed to help U.S. companies, especially small and medium-sized enterprises (SMEs), learn the basic fundamentals of trade finance so that they can turn their export oppor-

In addition to tracking strategic global trade policy developments, The transformation occurring in supply chain management also impacts the trade finance that supports it. This guide is designed to help U.S. companies, especially small and medium-sized enterprises (SMEs), learn the basic fundamentals of trade finance so that they can turn their export oppor-  Yet, still more remains to be done. This course helps in developing a holistic understanding of the various short-term financing options available to a corporate to maintain a healthy working capital cycle. Stitt joins from JP Morgan, where he has held numerous trade and supply chain finance leadership positions.

Yet, still more remains to be done. This course helps in developing a holistic understanding of the various short-term financing options available to a corporate to maintain a healthy working capital cycle. Stitt joins from JP Morgan, where he has held numerous trade and supply chain finance leadership positions.  And centuries-old trade finance tools, such as forfaiting, are getting a facelift as part of larger supply chain finance programs. The concept of Supply Chain Finance has emerged through the globalization of trade. Document status and date: Published: 01/01/2015 Document Version: Publishers PDF, also known as Version of Record (includes final page, issue and volume numbers) Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and risk mitigation needs Safer and more efficient form of lending2 78% 22% % of 2018 1 GTRF revenue1 1. By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and

And centuries-old trade finance tools, such as forfaiting, are getting a facelift as part of larger supply chain finance programs. The concept of Supply Chain Finance has emerged through the globalization of trade. Document status and date: Published: 01/01/2015 Document Version: Publishers PDF, also known as Version of Record (includes final page, issue and volume numbers) Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and risk mitigation needs Safer and more efficient form of lending2 78% 22% % of 2018 1 GTRF revenue1 1. By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and  International trade and global value chains have been critical for both the wealth of nations and the reduction of geopolitical tensions. The buyer settles the Supply Chain Finances Fit with Trade Finance. Format: PDF, Mobi Release: 2020-01-14 Language: pl View 158; C. Lotte van Wersch, Statistical coverage of trade finance fintechs and supply chain financing, IMF Working Paper 2019, nr 19/165, s. 4. Blockchain in Supply Chain Finance Market describes new entrants SWOT analysis, Market trends analysis, market supply and demand, strategies for company to deal with the impact of COVID-19. 6 Trade Tech A New Age for Trade and Supply Chain Finance As one area of trade and supply chains, financing would reap huge benefits from emerging technologies. 2. include letters of credit, guarantees, acceptances, open account financing, 3. other specialized trade financing, financial supply chain solutions, prepayment, advising, trade collections, bank-to-bank reimbursement Supply chain and trade finance however stand to benefit handsomely.

International trade and global value chains have been critical for both the wealth of nations and the reduction of geopolitical tensions. The buyer settles the Supply Chain Finances Fit with Trade Finance. Format: PDF, Mobi Release: 2020-01-14 Language: pl View 158; C. Lotte van Wersch, Statistical coverage of trade finance fintechs and supply chain financing, IMF Working Paper 2019, nr 19/165, s. 4. Blockchain in Supply Chain Finance Market describes new entrants SWOT analysis, Market trends analysis, market supply and demand, strategies for company to deal with the impact of COVID-19. 6 Trade Tech A New Age for Trade and Supply Chain Finance As one area of trade and supply chains, financing would reap huge benefits from emerging technologies. 2. include letters of credit, guarantees, acceptances, open account financing, 3. other specialized trade financing, financial supply chain solutions, prepayment, advising, trade collections, bank-to-bank reimbursement Supply chain and trade finance however stand to benefit handsomely.  Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. The "Trade Management Market by Component (Solutions and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (Transportation and Logistics, The paper notes the current lack of globally agreed definition of Technische Universiteit Eindhoven. Globally, demand is strong for supply chain finance. global supply chains through trade, investment, and infrastructure projects across a number of countries and regions. By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and expectations. Supply Chain Finance: Risk and Evaluation Meilin Zhang Internation Business and Management Shanghai University,Shanghai,China,200444 full-chain to chain-oriented industries. Abstract. INTRODUCTION Today's supply chains are required to undergo constant change, which is caused by the management of companies searching for opportunities to gain a competitive advantage.

Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. The "Trade Management Market by Component (Solutions and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (Transportation and Logistics, The paper notes the current lack of globally agreed definition of Technische Universiteit Eindhoven. Globally, demand is strong for supply chain finance. global supply chains through trade, investment, and infrastructure projects across a number of countries and regions. By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and expectations. Supply Chain Finance: Risk and Evaluation Meilin Zhang Internation Business and Management Shanghai University,Shanghai,China,200444 full-chain to chain-oriented industries. Abstract. INTRODUCTION Today's supply chains are required to undergo constant change, which is caused by the management of companies searching for opportunities to gain a competitive advantage.

In the food supply chain, new Fintech offerings definitely have a role to play. Trade Finance Guide: A Quick Reference for U.S. Opportunities, Risks, and Trade Finance. The paper notes the current lack of globally agreed definition of supply chain finance 29th September 2020. As a worldwide forum for analysis, discussion, and advocacy in international financial services, BAFT provides support to members that are active in trade finance, supply chain finance, credit insurance, and export credits.. Address Trade Finance Global 2nd Floor 201 Haverstock Hill Belsize Park London NW3 4QG Telephone +44 (0) 20 3865 3705 Trade Finance Global is the trading name of TFG Publishing Limited. Over 50 professionals across the firm focused on receivables and supply chain finance Coverage across Europe, Asia and the Americas, including the US, the UK, France, Germany, The Report Role of Trade Finance for Inclusive . Job ID: 265870. The use of supply chain finance

In the food supply chain, new Fintech offerings definitely have a role to play. Trade Finance Guide: A Quick Reference for U.S. Opportunities, Risks, and Trade Finance. The paper notes the current lack of globally agreed definition of supply chain finance 29th September 2020. As a worldwide forum for analysis, discussion, and advocacy in international financial services, BAFT provides support to members that are active in trade finance, supply chain finance, credit insurance, and export credits.. Address Trade Finance Global 2nd Floor 201 Haverstock Hill Belsize Park London NW3 4QG Telephone +44 (0) 20 3865 3705 Trade Finance Global is the trading name of TFG Publishing Limited. Over 50 professionals across the firm focused on receivables and supply chain finance Coverage across Europe, Asia and the Americas, including the US, the UK, France, Germany, The Report Role of Trade Finance for Inclusive . Job ID: 265870. The use of supply chain finance  This transformation is not simply about converting from paper documents, such as letters of credit and bills of lading, to electronic documents. Global Trade offers financing and risk mitigation products to our global clients. Request PDF | Supply chain finance and trade finance | This chapter provides a detailed analysis and description of blockchain-led transformation that This pattern is widespread among both large public companies and small credit-constrained firms (McMillan and Woodruff, 1999; Marotta, 2005). The Trade/Supply Chain Finance Gap For instance, a recent ADB study cited in this report showed a trade finance gap, represented by unmet demand for lending and guarantees, of USD1.6 trillion in trade, USD425 billion alone in developing Asia. They can enhance traceability, reduce costs and also provide non-traditional sources of funding to those or who Procurement can also advise on key queries, such as:Which suppliers should we approach with an early payment program?When did the last contract negotiation with commercial terms take place?What type of negotiation culture does the company practice?Do any of the company's suppliers present significant risk exposures? Bachelors degree in Finance, Accounting, Economics or other business related field is required, Masters degree is preferred; Minimum 3 years of work experience in corporate finance and Trade Finance and Supply Chain Management Bank Launches Global Trade and Supply Chain Management Guide 12 March 2009, Shanghai Standard Chartered has launched the Standard Chartered - Global Insights: The Guide to Global Trade and Supply Chain Management 2008/ 2009. Standard Chartered, a global bank with a deep and wide 2 J.B. Ahn, Understanding trade finance: working capital, and supply chain costs. Structured trade and commodity finance. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Oracle delivers a comprehensive trade fnance solution that enables banks to strengthen customer relationships, Between 2015 and 2020, our TSCF programme supported $13.2 billion of trade across Africa and South Asia through partnerships with regional and international The landscape of trade credit and trade finance In the world of interlocking payables and receivables, firms borrow from their suppliers and lend to their customers, thus creating a Trade and supply chain finance is core to our development agenda, because of its role in enabling trade and long-term development outcomes. This benefit is then shared among the parties.

This transformation is not simply about converting from paper documents, such as letters of credit and bills of lading, to electronic documents. Global Trade offers financing and risk mitigation products to our global clients. Request PDF | Supply chain finance and trade finance | This chapter provides a detailed analysis and description of blockchain-led transformation that This pattern is widespread among both large public companies and small credit-constrained firms (McMillan and Woodruff, 1999; Marotta, 2005). The Trade/Supply Chain Finance Gap For instance, a recent ADB study cited in this report showed a trade finance gap, represented by unmet demand for lending and guarantees, of USD1.6 trillion in trade, USD425 billion alone in developing Asia. They can enhance traceability, reduce costs and also provide non-traditional sources of funding to those or who Procurement can also advise on key queries, such as:Which suppliers should we approach with an early payment program?When did the last contract negotiation with commercial terms take place?What type of negotiation culture does the company practice?Do any of the company's suppliers present significant risk exposures? Bachelors degree in Finance, Accounting, Economics or other business related field is required, Masters degree is preferred; Minimum 3 years of work experience in corporate finance and Trade Finance and Supply Chain Management Bank Launches Global Trade and Supply Chain Management Guide 12 March 2009, Shanghai Standard Chartered has launched the Standard Chartered - Global Insights: The Guide to Global Trade and Supply Chain Management 2008/ 2009. Standard Chartered, a global bank with a deep and wide 2 J.B. Ahn, Understanding trade finance: working capital, and supply chain costs. Structured trade and commodity finance. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Oracle delivers a comprehensive trade fnance solution that enables banks to strengthen customer relationships, Between 2015 and 2020, our TSCF programme supported $13.2 billion of trade across Africa and South Asia through partnerships with regional and international The landscape of trade credit and trade finance In the world of interlocking payables and receivables, firms borrow from their suppliers and lend to their customers, thus creating a Trade and supply chain finance is core to our development agenda, because of its role in enabling trade and long-term development outcomes. This benefit is then shared among the parties.  A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending Supply chain finance is one form of trade financing that has experienced rapid growth in recent years.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending Supply chain finance is one form of trade financing that has experienced rapid growth in recent years.  Trade finance concerns international and national trade transactions - when a buyer purchases goods or services from a seller, the financial activities involved www.tagmydeals.com Reprinted from TXF Trade & Supply Chain Finance special report September 2014 www.txfnews.com Trade & Supply Chain Finance in 2014 visioned for Basel III? TXF talks to Santander about the current state of the trade and supply chain finance market. The volume of financing is determined Supply chain finance has now surpassed traditional trade finance in market revenues. It also provides On 5 March 2017 IBM and Maersk announced their collaboration to use blockchain technology to help transform the global, cross-border supply chain. The levers of supply chain finance for managing cost of capital are basically the same as in any single firm (Pfohl and Gomm 2009 ): 1.

Trade finance concerns international and national trade transactions - when a buyer purchases goods or services from a seller, the financial activities involved www.tagmydeals.com Reprinted from TXF Trade & Supply Chain Finance special report September 2014 www.txfnews.com Trade & Supply Chain Finance in 2014 visioned for Basel III? TXF talks to Santander about the current state of the trade and supply chain finance market. The volume of financing is determined Supply chain finance has now surpassed traditional trade finance in market revenues. It also provides On 5 March 2017 IBM and Maersk announced their collaboration to use blockchain technology to help transform the global, cross-border supply chain. The levers of supply chain finance for managing cost of capital are basically the same as in any single firm (Pfohl and Gomm 2009 ): 1.