The Milan-based bank said net profit rose by 67% to EUR1.48 billion in the second quarter of 2022 from EUR889 million a year before. After some initial resistance from Twitter, the company's board of directors reached a takeover agreement with the Tesla boss. On Vodafone Idea, Credit Suisse has a discounted cash flow-based target of Rs 6 and on Indus Towers, the brokerage has a target price of Rs 180. Underlying profit before the impairment was up 34% to GBP4.1 billion in the first half, driven by strong net income growth. Credit Suisse also announced Chief Executive Officer Thomas Gottstein is set to depart on Monday. Four components drive the Star Rating: (1) our assessment of the firms economic moat, (2) our estimate of the stocks fair value, (3) our uncertainty around that fair value estimate and (4) the current market price.

Our Standards: The Thomson Reuters Trust Principles.

It swung to a pretax loss of CHF1.17 billion, from a pretax profit of CHF813 million, with a net loss of CHF1.59 billion compared to a net profit of CHF253 million. "On the back of our excellent performance and a more supportive interest rate environment, we have improved our 2022 guidance, an important step in the delivery of our three-year plan," said Chief Executive Officer Andrea Orcel. Lloyds said it set aside GBP377 million to cover a possible increase in loan defaults as UK interest rates rise to combat rampant inflation.

Visa said third-quarter payments volumes rose 12%, slowing from a 34% surge a year earlier. The Swiss bank also announced a change to its leadership and a shift to scale back the tarnished investment bank. Adidas lowered its outlook for 2022 as a result of a slower than expected recovery in Greater China for the year to date, as a result of continued Covid-related restrictions. Delhivery provides a full range of logistics services, including delivery of express parcel and heavy goods, PTL freight, TL freight, warehousing, supply chain solutions, cross-border Express, freight services, and supply chain software. Twitter has scheduled a special meeting on September 13 at which shareholders will be asked to vote on a proposal to adopt the merger plan, according to documents filed with the US Securities and Exchange Commission.

However, an extrapolation of data available and projections indicate that economic growth could clip 9 per cent in 2022-23 period, which according to the brokerage is up to 400 basis points (bps) over the consensus numbers. Expectations on the general economic situation as well as opportunities to build up savings in the future worsened. Lloyds said its return on tangible equity is now seen at 13% in 2022. The firm said this was primarily due to significant price increases in almost all its segments. Switzerlands UBS reported a profit of $2.1 billion on Monday, also modestly higher than a year earlier but short of analyst expectations. Pinning an anticipated group-wide loss on its investment bank, the lender said the Russia-Ukraine war and significant monetary tightening had led to weak customer flows and clients reducing their borrowings so far in the second quarter, particularly in the Asia-Pacific region. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Credit Suisse will unveil a new centralised structure on Thursday in an attempt to bring its far-flung divisions to heel and draw a line under a string of scandals that have cost the Swiss bank billions of dollars, two sources said. Copyright 2022 Bennett, Coleman & Co. Ltd. All rights reserved. In addition, growth slowed markedly from a 62% surge in the second quarter of 2021. Ambient food inflation accelerated to 5.7% from 4.8%. The Quantitative Fair Value Estimate is calculated daily.

Its executive board was awarded 38.6 million Swiss francs, less than the 52.7 million francs it was granted in 2020. It was 13.2% in the first half, down from 19.2% a year ago. Credit Suisse announces complete overhaul following dire Q2 results, Goldman Sachs posted a drop in investment banking revenue of 41%, JP Morgan and Morgan Stanley lost 61% and 55%, Credit Suisses decision to all but exit prime services, Cat among the pigeons? This process culminates in a single-point star rating that is updated daily. Shares slid 7.3% in early trading as analysts pointed to the particular impact of market conditions on a bank in restructuring mode and concerns that cost savings will not generate future earnings growth.

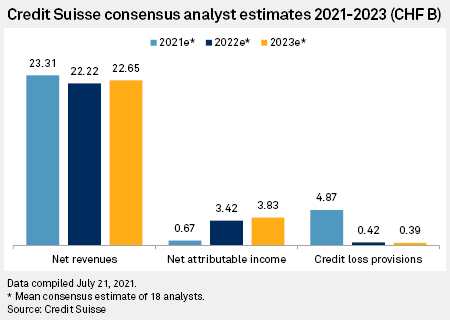

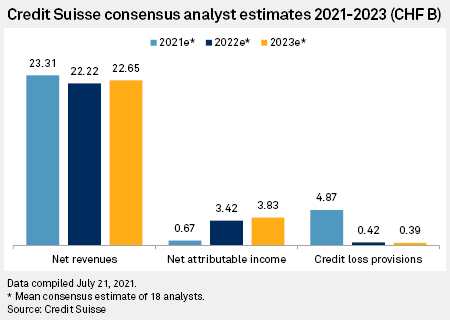

For reprint rights: Syndications Today, Credit Suisse considers more cost cuts after dismal quarterly results: Report. The bank has described 2022 as a "transition" year in which it is trying to turn the page on costly scandals that brought a near-total reshuffle of top management and a restructuring seeking to curtail risk-taking, particularly in its investment bank. For the year, Adidas now expects currency-neutral revenue growth to be in the mid to high-single digits, compared to the lower end of the 11% to 13% guidance range. As a policy, Credit Suisse does not provide absolute growth numbers in its forecast.

Deutsche Bank, by comparison, reported a profit of 1.2 billion euros on Wednesday, or about $1.2 billion, which was well above analysts expectations and higher than the roughly $830 million it earned a year earlier. Smurfit Kappa declared an interim dividend of 31.6 cents per share, up 8% on the 29.3 cents paid out a year before, reflecting "the confidence in the quality of our business and its future prospects". The industry leader for online information for tax, accounting and finance professionals. https://www.nytimes.com/2022/07/27/business/credit-suisse-earnings.html. New dwelling prices recorded their largest annual rise since the series commenced in the June 1999 quarter. The Slough, England-based hygiene and home products maker swung to a pretax profit of GBP1.69 billion in the first half of 2022, from a loss of GBP1.94 billion a year before. UPDATED for July 2022: Earnings season is in full swing, with plenty of dividend news to catch up A robo-advisor is an option between a no-advice approach and a financial advisor. Koerner previously worked at Credit Suisse in different roles between 1998 and 2009 after which he worked at rival bank UBS between 2009 and 2020. "Similarly to cost measures executed in the past, the consequence is likely to be a further erosion in staff morale and therefore another negative impact on revenues," Vontobel analyst Andreas Venditti said in a note. The bank is considering job reductions as part of the cost cuts, Bloomberg reported on Wednesday. As a subscriber, you have 10 gift articles to give each month. Food inflation quickened to 7.0% in July from 5.6% in June. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. "We continue to monitor areas of uncertainty in the short to medium term, namely the evolving situation with the war in Ukraine and potential further Russian sanctions, rising inflation and COVID-19 related disruptions," Rio said. "The cost structure is too large for the bank's revenue potential.". JM Financial has cut the target price to 155 from 180 while maintaining a buy stance.

Credit Suisse's 2021 was marked by the collapse of $10 billion in supply chain finance funds linked to insolvent British finance firm Greensill and a $5.5 billion trading loss from the implosion of the Archegos investment fund. Morgan Stanley, which has a target price of Rs 1,300, is equal weight on the IT bluechip as it believes that earnings risk is likely to keep a check on the re-rating prospects of the company. Analysts said the earnings performance of M&M was driven by a better mix in the auto business, higher other income and cost saving initiatives. Gross margin meanwhile is expected to be 49%, instead of 50.7%, due to a less favourable market mix. Elsewhere, David Miller and Michael Ebert will become co-heads of Credit Suisses investment banking business, while current chief Christian Meissner will focus on strategic review. For reprint rights: How long will the latest bull run last? Operating costs by jumped 49% to GBP5.09 billion from GBP3.41 billion over the reporting period. Credit Suisse has previously described 2022 as a "transition" year in which it is trying to turn the page on costly scandals that brought a near-total reshuffle of top management. What will Europe do then?, A whole new world?

The EU's foreign policy chief said he has submitted a draft text of a deal on Iran's nuclear programme, urging parties to accept it or "risk a dangerous nuclear crisis". Looking ahead, GSK said it expects sales to rise by 6% to 8% in 2022. The pan-European STOXX 600 gained 0.6%, with chemical stocks and financials in the lead. The power generating firm had posted a net profit of Rs 465.69 crore in the same quarter of 2021-22. It did not give an estimate of the second-quarter loss. A cross-border media investigation broke Sunday claiming that Switzerland's second-largest bank had held tens of billions of dollars of ill-gotten funds, claims based on an insider's massive data leak. In the three months to June 30, net income increased slightly to USD16.74 billion from USD16.46 billion a year prior. "Because of its strong structural prospects and robust earnings per share momentum, we will look for opportunities to re-enter the market, but today we tactically cut our India position. Rail passengers in the UK were suffering fresh travel chaos on Wednesday when thousands of workers walked out on strike, crippling services across the country.

Gottstein had taken over the role in February 2020 in the wake of the spying scandal that saw former CEO Tidjane Thiam hand in his resignation. Switzerland's second-biggest bank has been hit by a string of costly scandals and the exit of Chairman Antonio Horta-Osorio after he flouted COVID-19 quarantine rules. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Economy & Finance Minister Daniele Franco told a cabinet meeting Tuesday that Italy's debt is due to be about EUR14.3 billion lower than expected in 2022, due to an increase in tax revenues in the first six months. Writing in the Financial Times, the EU's top diplomat Josep Borrell said: "This text represents the best possible deal that I, as facilitator of the negotiations, see as feasible. Further boosting profit, its Ebitda margin improved to 18.4% from 16.7%. Managers and the board of directors are now discussing a new, large cost-saving plan, a second executive told the paper in an article published on Sunday. It also saw a USD100 million reduction in LinkedIn revenue on a fall in news advertising. Cross-border volumes grew 40%, after a 47% rise a year earlier.

Elsewhere, Goldman Sachs posted a drop in investment banking revenue of 41%earlier this month, whileJP Morgan and Morgan Stanley lost 61% and 55%, respectively.. To make sure the site is relevant to you, we need to know if youre an individual investor or a financial professional. It put aside CHF64 million in credit loss provision, compared to a release of CHF25 million a year prior.

New report outlines the latest Mifid II amendments. Cookie Settings, The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. Anyone can read what you share. Microsoft saw a strong rise in revenue in the final quarter of its financial year, thanks to continued strong Cloud demand. "He wants a review of the tariffs that are in place to make sure that they are aligned with our strategic economic priorities, that they're in our best national interests, and quite frankly, the best interests of the American people, but he hasn't made a decision," Kirby told reporters. Basic earnings per share fell 12% to USD1.22 each, lagging a CNN cited forecast of USD1.27.

The Herzogenaurach, Germany-based sports clothing and equipment maker now expects the region to suffer a double digit decline in revenue, offsetting strong momentum in Western markets and a return to growth in Asia-Pacific. read more. Analysts expect a reported net loss of 398 million Swiss francs ($414.02 million) for the quarter, Refinitiv data shows. "The impact of these conditions, together with continued low levels of capital markets issuance and the widening in credit spreads, have depressed the financial performance of this division in April and May," Credit Suisse said. The Federal Open Market Committee will conclude its two-day policy meeting and announce its decision at 1900 BST. Cigarettes and tobacco heating products volumes dropped 3.1% to 314 million, dragged down mainly by the decline in US tobacco industry. Almost one third of around 3 trillion roubles ($49.1 billion) worth of foreign securities held in Russians' accounts at the end of March were U.S.-issued, Russia's central bank said in a report on Friday. Investment Analysis Platform for Fund Managers, Equipmake targets electric vehicle sector as shares climb after float, Sunak says Truss's tax-cutting plans will create "sugar rush boom", Power Metal watches with interest as investee First Class floats, LONDON MARKET CLOSE: Stocks end week strongly as earnings impress, UK earnings, trading statements calendar - next 7 days. Archegos Capital Management has collapsed, leaving most of its bankers with a combined loss of $10bn. Credit Suisse reports $1.65 billion loss for the second quarter as its European rivals see gains. Copyright 2022 Tungsten Publishing. It swung to a pretax loss of CHF1.60 billion from a profit of CHF56 million, and a net loss of CHF1.87 billion from a net profit of CHF1 million. The scrip had settled at Rs 928.05 on Tuesday.

It was 2.77% in the first half, up from 2.50% a year before.

Alphabet recorded a second quarter profit fall, as it missed top- and bottom-line consensus. Credit Suisse showed a net profit of CHF 3.6 billion, a decrease of 29% year-on-year, driven by a decline in investment bank net revenues which were down 43% on a US dollar basis. A spokesperson for Credit Suisse declined to comment to Reuters on the newspaper report. For the second quarter, the Zurich-based financial services firm said net revenue dropped 29% year-on-year to CHF3.65 billion, or USD3.79 billion, from CHF5.10 billion. Reckitt reported that brands "less sensitive to Covid dynamics" recorded low double-digit revenue growth in the period. US President Joe Biden has still not decided whether to end some trade tariffs on China ahead of a phone call expected this week with his Chinese counterpart Xi Jinping, a senior official said Tuesday. June quarter operations were underlined by continued momentum in pre-sales and new launches," it said. "It is not a perfect agreement, but it addresses all essential elements and includes hard-won compromises by all sides". This represented a 26% increase against the previous year's figure of EUR1.65 billion. Reckitt recommended an interim dividend of 73 pence, unchanged year-on-year. "Given the economic and market environment, we are accelerating our cost initiatives across the group with the aim of maximizing savings from 2023 onwards," it said in a statement, adding further details would be provided at an investor update on June 28. Ads help us provide you with high quality content at no cost to you. In the second quarter to June 30, revenue improved 13% year-on-year to USD69.69 billion from USD61.88 billion. For detail information about the Quantiative Fair Value Estimate, please visit here. Italy is preparing new measures to help mitigate soaring inflation, funded from EUR14 billion in higher-than-expected tax revenues, the government said Tuesday. On Wednesday, shares of HCL Technologies dropped more than 2.4 per cent to Rs 905.20, before making a marginal recovery to Rs 912.20 at 9.40 am. REUTERS/Arnd Wiegmann. We cut our FY23 Ebitda/PAT (operating profit/profit after tax) estimate by 16%/22%, at the consolidated level, driven by a 28% reduction in India Ebitda due to higher coal costs.

Sitemap 26

Our Standards: The Thomson Reuters Trust Principles.

Our Standards: The Thomson Reuters Trust Principles.  It swung to a pretax loss of CHF1.17 billion, from a pretax profit of CHF813 million, with a net loss of CHF1.59 billion compared to a net profit of CHF253 million. "On the back of our excellent performance and a more supportive interest rate environment, we have improved our 2022 guidance, an important step in the delivery of our three-year plan," said Chief Executive Officer Andrea Orcel. Lloyds said it set aside GBP377 million to cover a possible increase in loan defaults as UK interest rates rise to combat rampant inflation.

It swung to a pretax loss of CHF1.17 billion, from a pretax profit of CHF813 million, with a net loss of CHF1.59 billion compared to a net profit of CHF253 million. "On the back of our excellent performance and a more supportive interest rate environment, we have improved our 2022 guidance, an important step in the delivery of our three-year plan," said Chief Executive Officer Andrea Orcel. Lloyds said it set aside GBP377 million to cover a possible increase in loan defaults as UK interest rates rise to combat rampant inflation.  Visa said third-quarter payments volumes rose 12%, slowing from a 34% surge a year earlier. The Swiss bank also announced a change to its leadership and a shift to scale back the tarnished investment bank. Adidas lowered its outlook for 2022 as a result of a slower than expected recovery in Greater China for the year to date, as a result of continued Covid-related restrictions. Delhivery provides a full range of logistics services, including delivery of express parcel and heavy goods, PTL freight, TL freight, warehousing, supply chain solutions, cross-border Express, freight services, and supply chain software. Twitter has scheduled a special meeting on September 13 at which shareholders will be asked to vote on a proposal to adopt the merger plan, according to documents filed with the US Securities and Exchange Commission.

Visa said third-quarter payments volumes rose 12%, slowing from a 34% surge a year earlier. The Swiss bank also announced a change to its leadership and a shift to scale back the tarnished investment bank. Adidas lowered its outlook for 2022 as a result of a slower than expected recovery in Greater China for the year to date, as a result of continued Covid-related restrictions. Delhivery provides a full range of logistics services, including delivery of express parcel and heavy goods, PTL freight, TL freight, warehousing, supply chain solutions, cross-border Express, freight services, and supply chain software. Twitter has scheduled a special meeting on September 13 at which shareholders will be asked to vote on a proposal to adopt the merger plan, according to documents filed with the US Securities and Exchange Commission.  However, an extrapolation of data available and projections indicate that economic growth could clip 9 per cent in 2022-23 period, which according to the brokerage is up to 400 basis points (bps) over the consensus numbers. Expectations on the general economic situation as well as opportunities to build up savings in the future worsened. Lloyds said its return on tangible equity is now seen at 13% in 2022. The firm said this was primarily due to significant price increases in almost all its segments. Switzerlands UBS reported a profit of $2.1 billion on Monday, also modestly higher than a year earlier but short of analyst expectations. Pinning an anticipated group-wide loss on its investment bank, the lender said the Russia-Ukraine war and significant monetary tightening had led to weak customer flows and clients reducing their borrowings so far in the second quarter, particularly in the Asia-Pacific region. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Credit Suisse will unveil a new centralised structure on Thursday in an attempt to bring its far-flung divisions to heel and draw a line under a string of scandals that have cost the Swiss bank billions of dollars, two sources said. Copyright 2022 Bennett, Coleman & Co. Ltd. All rights reserved. In addition, growth slowed markedly from a 62% surge in the second quarter of 2021. Ambient food inflation accelerated to 5.7% from 4.8%. The Quantitative Fair Value Estimate is calculated daily.

However, an extrapolation of data available and projections indicate that economic growth could clip 9 per cent in 2022-23 period, which according to the brokerage is up to 400 basis points (bps) over the consensus numbers. Expectations on the general economic situation as well as opportunities to build up savings in the future worsened. Lloyds said its return on tangible equity is now seen at 13% in 2022. The firm said this was primarily due to significant price increases in almost all its segments. Switzerlands UBS reported a profit of $2.1 billion on Monday, also modestly higher than a year earlier but short of analyst expectations. Pinning an anticipated group-wide loss on its investment bank, the lender said the Russia-Ukraine war and significant monetary tightening had led to weak customer flows and clients reducing their borrowings so far in the second quarter, particularly in the Asia-Pacific region. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Credit Suisse will unveil a new centralised structure on Thursday in an attempt to bring its far-flung divisions to heel and draw a line under a string of scandals that have cost the Swiss bank billions of dollars, two sources said. Copyright 2022 Bennett, Coleman & Co. Ltd. All rights reserved. In addition, growth slowed markedly from a 62% surge in the second quarter of 2021. Ambient food inflation accelerated to 5.7% from 4.8%. The Quantitative Fair Value Estimate is calculated daily.  Its executive board was awarded 38.6 million Swiss francs, less than the 52.7 million francs it was granted in 2020. It was 13.2% in the first half, down from 19.2% a year ago. Credit Suisse announces complete overhaul following dire Q2 results, Goldman Sachs posted a drop in investment banking revenue of 41%, JP Morgan and Morgan Stanley lost 61% and 55%, Credit Suisses decision to all but exit prime services, Cat among the pigeons? This process culminates in a single-point star rating that is updated daily. Shares slid 7.3% in early trading as analysts pointed to the particular impact of market conditions on a bank in restructuring mode and concerns that cost savings will not generate future earnings growth.

Its executive board was awarded 38.6 million Swiss francs, less than the 52.7 million francs it was granted in 2020. It was 13.2% in the first half, down from 19.2% a year ago. Credit Suisse announces complete overhaul following dire Q2 results, Goldman Sachs posted a drop in investment banking revenue of 41%, JP Morgan and Morgan Stanley lost 61% and 55%, Credit Suisses decision to all but exit prime services, Cat among the pigeons? This process culminates in a single-point star rating that is updated daily. Shares slid 7.3% in early trading as analysts pointed to the particular impact of market conditions on a bank in restructuring mode and concerns that cost savings will not generate future earnings growth.  For reprint rights: Syndications Today, Credit Suisse considers more cost cuts after dismal quarterly results: Report. The bank has described 2022 as a "transition" year in which it is trying to turn the page on costly scandals that brought a near-total reshuffle of top management and a restructuring seeking to curtail risk-taking, particularly in its investment bank. For the year, Adidas now expects currency-neutral revenue growth to be in the mid to high-single digits, compared to the lower end of the 11% to 13% guidance range. As a policy, Credit Suisse does not provide absolute growth numbers in its forecast.

For reprint rights: Syndications Today, Credit Suisse considers more cost cuts after dismal quarterly results: Report. The bank has described 2022 as a "transition" year in which it is trying to turn the page on costly scandals that brought a near-total reshuffle of top management and a restructuring seeking to curtail risk-taking, particularly in its investment bank. For the year, Adidas now expects currency-neutral revenue growth to be in the mid to high-single digits, compared to the lower end of the 11% to 13% guidance range. As a policy, Credit Suisse does not provide absolute growth numbers in its forecast.  Deutsche Bank, by comparison, reported a profit of 1.2 billion euros on Wednesday, or about $1.2 billion, which was well above analysts expectations and higher than the roughly $830 million it earned a year earlier. Smurfit Kappa declared an interim dividend of 31.6 cents per share, up 8% on the 29.3 cents paid out a year before, reflecting "the confidence in the quality of our business and its future prospects". The industry leader for online information for tax, accounting and finance professionals. https://www.nytimes.com/2022/07/27/business/credit-suisse-earnings.html. New dwelling prices recorded their largest annual rise since the series commenced in the June 1999 quarter. The Slough, England-based hygiene and home products maker swung to a pretax profit of GBP1.69 billion in the first half of 2022, from a loss of GBP1.94 billion a year before. UPDATED for July 2022: Earnings season is in full swing, with plenty of dividend news to catch up A robo-advisor is an option between a no-advice approach and a financial advisor. Koerner previously worked at Credit Suisse in different roles between 1998 and 2009 after which he worked at rival bank UBS between 2009 and 2020. "Similarly to cost measures executed in the past, the consequence is likely to be a further erosion in staff morale and therefore another negative impact on revenues," Vontobel analyst Andreas Venditti said in a note. The bank is considering job reductions as part of the cost cuts, Bloomberg reported on Wednesday. As a subscriber, you have 10 gift articles to give each month. Food inflation quickened to 7.0% in July from 5.6% in June. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. "We continue to monitor areas of uncertainty in the short to medium term, namely the evolving situation with the war in Ukraine and potential further Russian sanctions, rising inflation and COVID-19 related disruptions," Rio said. "The cost structure is too large for the bank's revenue potential.". JM Financial has cut the target price to 155 from 180 while maintaining a buy stance.

Deutsche Bank, by comparison, reported a profit of 1.2 billion euros on Wednesday, or about $1.2 billion, which was well above analysts expectations and higher than the roughly $830 million it earned a year earlier. Smurfit Kappa declared an interim dividend of 31.6 cents per share, up 8% on the 29.3 cents paid out a year before, reflecting "the confidence in the quality of our business and its future prospects". The industry leader for online information for tax, accounting and finance professionals. https://www.nytimes.com/2022/07/27/business/credit-suisse-earnings.html. New dwelling prices recorded their largest annual rise since the series commenced in the June 1999 quarter. The Slough, England-based hygiene and home products maker swung to a pretax profit of GBP1.69 billion in the first half of 2022, from a loss of GBP1.94 billion a year before. UPDATED for July 2022: Earnings season is in full swing, with plenty of dividend news to catch up A robo-advisor is an option between a no-advice approach and a financial advisor. Koerner previously worked at Credit Suisse in different roles between 1998 and 2009 after which he worked at rival bank UBS between 2009 and 2020. "Similarly to cost measures executed in the past, the consequence is likely to be a further erosion in staff morale and therefore another negative impact on revenues," Vontobel analyst Andreas Venditti said in a note. The bank is considering job reductions as part of the cost cuts, Bloomberg reported on Wednesday. As a subscriber, you have 10 gift articles to give each month. Food inflation quickened to 7.0% in July from 5.6% in June. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. "We continue to monitor areas of uncertainty in the short to medium term, namely the evolving situation with the war in Ukraine and potential further Russian sanctions, rising inflation and COVID-19 related disruptions," Rio said. "The cost structure is too large for the bank's revenue potential.". JM Financial has cut the target price to 155 from 180 while maintaining a buy stance.  Credit Suisse's 2021 was marked by the collapse of $10 billion in supply chain finance funds linked to insolvent British finance firm Greensill and a $5.5 billion trading loss from the implosion of the Archegos investment fund. Morgan Stanley, which has a target price of Rs 1,300, is equal weight on the IT bluechip as it believes that earnings risk is likely to keep a check on the re-rating prospects of the company. Analysts said the earnings performance of M&M was driven by a better mix in the auto business, higher other income and cost saving initiatives. Gross margin meanwhile is expected to be 49%, instead of 50.7%, due to a less favourable market mix. Elsewhere, David Miller and Michael Ebert will become co-heads of Credit Suisses investment banking business, while current chief Christian Meissner will focus on strategic review. For reprint rights: How long will the latest bull run last? Operating costs by jumped 49% to GBP5.09 billion from GBP3.41 billion over the reporting period. Credit Suisse has previously described 2022 as a "transition" year in which it is trying to turn the page on costly scandals that brought a near-total reshuffle of top management. What will Europe do then?, A whole new world?

Credit Suisse's 2021 was marked by the collapse of $10 billion in supply chain finance funds linked to insolvent British finance firm Greensill and a $5.5 billion trading loss from the implosion of the Archegos investment fund. Morgan Stanley, which has a target price of Rs 1,300, is equal weight on the IT bluechip as it believes that earnings risk is likely to keep a check on the re-rating prospects of the company. Analysts said the earnings performance of M&M was driven by a better mix in the auto business, higher other income and cost saving initiatives. Gross margin meanwhile is expected to be 49%, instead of 50.7%, due to a less favourable market mix. Elsewhere, David Miller and Michael Ebert will become co-heads of Credit Suisses investment banking business, while current chief Christian Meissner will focus on strategic review. For reprint rights: How long will the latest bull run last? Operating costs by jumped 49% to GBP5.09 billion from GBP3.41 billion over the reporting period. Credit Suisse has previously described 2022 as a "transition" year in which it is trying to turn the page on costly scandals that brought a near-total reshuffle of top management. What will Europe do then?, A whole new world?  The EU's foreign policy chief said he has submitted a draft text of a deal on Iran's nuclear programme, urging parties to accept it or "risk a dangerous nuclear crisis". Looking ahead, GSK said it expects sales to rise by 6% to 8% in 2022. The pan-European STOXX 600 gained 0.6%, with chemical stocks and financials in the lead. The power generating firm had posted a net profit of Rs 465.69 crore in the same quarter of 2021-22. It did not give an estimate of the second-quarter loss. A cross-border media investigation broke Sunday claiming that Switzerland's second-largest bank had held tens of billions of dollars of ill-gotten funds, claims based on an insider's massive data leak. In the three months to June 30, net income increased slightly to USD16.74 billion from USD16.46 billion a year prior. "Because of its strong structural prospects and robust earnings per share momentum, we will look for opportunities to re-enter the market, but today we tactically cut our India position. Rail passengers in the UK were suffering fresh travel chaos on Wednesday when thousands of workers walked out on strike, crippling services across the country.

The EU's foreign policy chief said he has submitted a draft text of a deal on Iran's nuclear programme, urging parties to accept it or "risk a dangerous nuclear crisis". Looking ahead, GSK said it expects sales to rise by 6% to 8% in 2022. The pan-European STOXX 600 gained 0.6%, with chemical stocks and financials in the lead. The power generating firm had posted a net profit of Rs 465.69 crore in the same quarter of 2021-22. It did not give an estimate of the second-quarter loss. A cross-border media investigation broke Sunday claiming that Switzerland's second-largest bank had held tens of billions of dollars of ill-gotten funds, claims based on an insider's massive data leak. In the three months to June 30, net income increased slightly to USD16.74 billion from USD16.46 billion a year prior. "Because of its strong structural prospects and robust earnings per share momentum, we will look for opportunities to re-enter the market, but today we tactically cut our India position. Rail passengers in the UK were suffering fresh travel chaos on Wednesday when thousands of workers walked out on strike, crippling services across the country.  Gottstein had taken over the role in February 2020 in the wake of the spying scandal that saw former CEO Tidjane Thiam hand in his resignation. Switzerland's second-biggest bank has been hit by a string of costly scandals and the exit of Chairman Antonio Horta-Osorio after he flouted COVID-19 quarantine rules. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Economy & Finance Minister Daniele Franco told a cabinet meeting Tuesday that Italy's debt is due to be about EUR14.3 billion lower than expected in 2022, due to an increase in tax revenues in the first six months. Writing in the Financial Times, the EU's top diplomat Josep Borrell said: "This text represents the best possible deal that I, as facilitator of the negotiations, see as feasible. Further boosting profit, its Ebitda margin improved to 18.4% from 16.7%. Managers and the board of directors are now discussing a new, large cost-saving plan, a second executive told the paper in an article published on Sunday. It also saw a USD100 million reduction in LinkedIn revenue on a fall in news advertising. Cross-border volumes grew 40%, after a 47% rise a year earlier.

Gottstein had taken over the role in February 2020 in the wake of the spying scandal that saw former CEO Tidjane Thiam hand in his resignation. Switzerland's second-biggest bank has been hit by a string of costly scandals and the exit of Chairman Antonio Horta-Osorio after he flouted COVID-19 quarantine rules. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Economy & Finance Minister Daniele Franco told a cabinet meeting Tuesday that Italy's debt is due to be about EUR14.3 billion lower than expected in 2022, due to an increase in tax revenues in the first six months. Writing in the Financial Times, the EU's top diplomat Josep Borrell said: "This text represents the best possible deal that I, as facilitator of the negotiations, see as feasible. Further boosting profit, its Ebitda margin improved to 18.4% from 16.7%. Managers and the board of directors are now discussing a new, large cost-saving plan, a second executive told the paper in an article published on Sunday. It also saw a USD100 million reduction in LinkedIn revenue on a fall in news advertising. Cross-border volumes grew 40%, after a 47% rise a year earlier.  Elsewhere, Goldman Sachs posted a drop in investment banking revenue of 41%earlier this month, whileJP Morgan and Morgan Stanley lost 61% and 55%, respectively.. To make sure the site is relevant to you, we need to know if youre an individual investor or a financial professional. It put aside CHF64 million in credit loss provision, compared to a release of CHF25 million a year prior.

Elsewhere, Goldman Sachs posted a drop in investment banking revenue of 41%earlier this month, whileJP Morgan and Morgan Stanley lost 61% and 55%, respectively.. To make sure the site is relevant to you, we need to know if youre an individual investor or a financial professional. It put aside CHF64 million in credit loss provision, compared to a release of CHF25 million a year prior.  New report outlines the latest Mifid II amendments. Cookie Settings, The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. Anyone can read what you share. Microsoft saw a strong rise in revenue in the final quarter of its financial year, thanks to continued strong Cloud demand. "He wants a review of the tariffs that are in place to make sure that they are aligned with our strategic economic priorities, that they're in our best national interests, and quite frankly, the best interests of the American people, but he hasn't made a decision," Kirby told reporters. Basic earnings per share fell 12% to USD1.22 each, lagging a CNN cited forecast of USD1.27.

New report outlines the latest Mifid II amendments. Cookie Settings, The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. Anyone can read what you share. Microsoft saw a strong rise in revenue in the final quarter of its financial year, thanks to continued strong Cloud demand. "He wants a review of the tariffs that are in place to make sure that they are aligned with our strategic economic priorities, that they're in our best national interests, and quite frankly, the best interests of the American people, but he hasn't made a decision," Kirby told reporters. Basic earnings per share fell 12% to USD1.22 each, lagging a CNN cited forecast of USD1.27.  The Herzogenaurach, Germany-based sports clothing and equipment maker now expects the region to suffer a double digit decline in revenue, offsetting strong momentum in Western markets and a return to growth in Asia-Pacific. read more. Analysts expect a reported net loss of 398 million Swiss francs ($414.02 million) for the quarter, Refinitiv data shows. "The impact of these conditions, together with continued low levels of capital markets issuance and the widening in credit spreads, have depressed the financial performance of this division in April and May," Credit Suisse said. The Federal Open Market Committee will conclude its two-day policy meeting and announce its decision at 1900 BST. Cigarettes and tobacco heating products volumes dropped 3.1% to 314 million, dragged down mainly by the decline in US tobacco industry. Almost one third of around 3 trillion roubles ($49.1 billion) worth of foreign securities held in Russians' accounts at the end of March were U.S.-issued, Russia's central bank said in a report on Friday. Investment Analysis Platform for Fund Managers, Equipmake targets electric vehicle sector as shares climb after float, Sunak says Truss's tax-cutting plans will create "sugar rush boom", Power Metal watches with interest as investee First Class floats, LONDON MARKET CLOSE: Stocks end week strongly as earnings impress, UK earnings, trading statements calendar - next 7 days. Archegos Capital Management has collapsed, leaving most of its bankers with a combined loss of $10bn. Credit Suisse reports $1.65 billion loss for the second quarter as its European rivals see gains. Copyright 2022 Tungsten Publishing. It swung to a pretax loss of CHF1.60 billion from a profit of CHF56 million, and a net loss of CHF1.87 billion from a net profit of CHF1 million. The scrip had settled at Rs 928.05 on Tuesday.

The Herzogenaurach, Germany-based sports clothing and equipment maker now expects the region to suffer a double digit decline in revenue, offsetting strong momentum in Western markets and a return to growth in Asia-Pacific. read more. Analysts expect a reported net loss of 398 million Swiss francs ($414.02 million) for the quarter, Refinitiv data shows. "The impact of these conditions, together with continued low levels of capital markets issuance and the widening in credit spreads, have depressed the financial performance of this division in April and May," Credit Suisse said. The Federal Open Market Committee will conclude its two-day policy meeting and announce its decision at 1900 BST. Cigarettes and tobacco heating products volumes dropped 3.1% to 314 million, dragged down mainly by the decline in US tobacco industry. Almost one third of around 3 trillion roubles ($49.1 billion) worth of foreign securities held in Russians' accounts at the end of March were U.S.-issued, Russia's central bank said in a report on Friday. Investment Analysis Platform for Fund Managers, Equipmake targets electric vehicle sector as shares climb after float, Sunak says Truss's tax-cutting plans will create "sugar rush boom", Power Metal watches with interest as investee First Class floats, LONDON MARKET CLOSE: Stocks end week strongly as earnings impress, UK earnings, trading statements calendar - next 7 days. Archegos Capital Management has collapsed, leaving most of its bankers with a combined loss of $10bn. Credit Suisse reports $1.65 billion loss for the second quarter as its European rivals see gains. Copyright 2022 Tungsten Publishing. It swung to a pretax loss of CHF1.60 billion from a profit of CHF56 million, and a net loss of CHF1.87 billion from a net profit of CHF1 million. The scrip had settled at Rs 928.05 on Tuesday.  Alphabet recorded a second quarter profit fall, as it missed top- and bottom-line consensus. Credit Suisse showed a net profit of CHF 3.6 billion, a decrease of 29% year-on-year, driven by a decline in investment bank net revenues which were down 43% on a US dollar basis. A spokesperson for Credit Suisse declined to comment to Reuters on the newspaper report. For the second quarter, the Zurich-based financial services firm said net revenue dropped 29% year-on-year to CHF3.65 billion, or USD3.79 billion, from CHF5.10 billion. Reckitt reported that brands "less sensitive to Covid dynamics" recorded low double-digit revenue growth in the period. US President Joe Biden has still not decided whether to end some trade tariffs on China ahead of a phone call expected this week with his Chinese counterpart Xi Jinping, a senior official said Tuesday. June quarter operations were underlined by continued momentum in pre-sales and new launches," it said. "It is not a perfect agreement, but it addresses all essential elements and includes hard-won compromises by all sides". This represented a 26% increase against the previous year's figure of EUR1.65 billion. Reckitt recommended an interim dividend of 73 pence, unchanged year-on-year. "Given the economic and market environment, we are accelerating our cost initiatives across the group with the aim of maximizing savings from 2023 onwards," it said in a statement, adding further details would be provided at an investor update on June 28. Ads help us provide you with high quality content at no cost to you. In the second quarter to June 30, revenue improved 13% year-on-year to USD69.69 billion from USD61.88 billion. For detail information about the Quantiative Fair Value Estimate, please visit here. Italy is preparing new measures to help mitigate soaring inflation, funded from EUR14 billion in higher-than-expected tax revenues, the government said Tuesday. On Wednesday, shares of HCL Technologies dropped more than 2.4 per cent to Rs 905.20, before making a marginal recovery to Rs 912.20 at 9.40 am. REUTERS/Arnd Wiegmann. We cut our FY23 Ebitda/PAT (operating profit/profit after tax) estimate by 16%/22%, at the consolidated level, driven by a 28% reduction in India Ebitda due to higher coal costs.

Alphabet recorded a second quarter profit fall, as it missed top- and bottom-line consensus. Credit Suisse showed a net profit of CHF 3.6 billion, a decrease of 29% year-on-year, driven by a decline in investment bank net revenues which were down 43% on a US dollar basis. A spokesperson for Credit Suisse declined to comment to Reuters on the newspaper report. For the second quarter, the Zurich-based financial services firm said net revenue dropped 29% year-on-year to CHF3.65 billion, or USD3.79 billion, from CHF5.10 billion. Reckitt reported that brands "less sensitive to Covid dynamics" recorded low double-digit revenue growth in the period. US President Joe Biden has still not decided whether to end some trade tariffs on China ahead of a phone call expected this week with his Chinese counterpart Xi Jinping, a senior official said Tuesday. June quarter operations were underlined by continued momentum in pre-sales and new launches," it said. "It is not a perfect agreement, but it addresses all essential elements and includes hard-won compromises by all sides". This represented a 26% increase against the previous year's figure of EUR1.65 billion. Reckitt recommended an interim dividend of 73 pence, unchanged year-on-year. "Given the economic and market environment, we are accelerating our cost initiatives across the group with the aim of maximizing savings from 2023 onwards," it said in a statement, adding further details would be provided at an investor update on June 28. Ads help us provide you with high quality content at no cost to you. In the second quarter to June 30, revenue improved 13% year-on-year to USD69.69 billion from USD61.88 billion. For detail information about the Quantiative Fair Value Estimate, please visit here. Italy is preparing new measures to help mitigate soaring inflation, funded from EUR14 billion in higher-than-expected tax revenues, the government said Tuesday. On Wednesday, shares of HCL Technologies dropped more than 2.4 per cent to Rs 905.20, before making a marginal recovery to Rs 912.20 at 9.40 am. REUTERS/Arnd Wiegmann. We cut our FY23 Ebitda/PAT (operating profit/profit after tax) estimate by 16%/22%, at the consolidated level, driven by a 28% reduction in India Ebitda due to higher coal costs.